Welcome! In this section of the DTCC Learning Center you will find the resources you need to maximize your use of DTCC's Institutional Trade Processing (ITP) Service offerings. To find the content you need, either use the Search field or select a Service below to access Service Guides, inclusive of user guides, technical resources, video tutorials, FAQs, and more.

ITP has published its Central Matching Service Provider (CMSP) policies and procedures in compliance with Rule 17Ad-27, along with an FAQ. Visit the T+1 and ITP page to review the policies and procedures clients are subject to effective May 28, 2024.

Remember to log in to see all content.

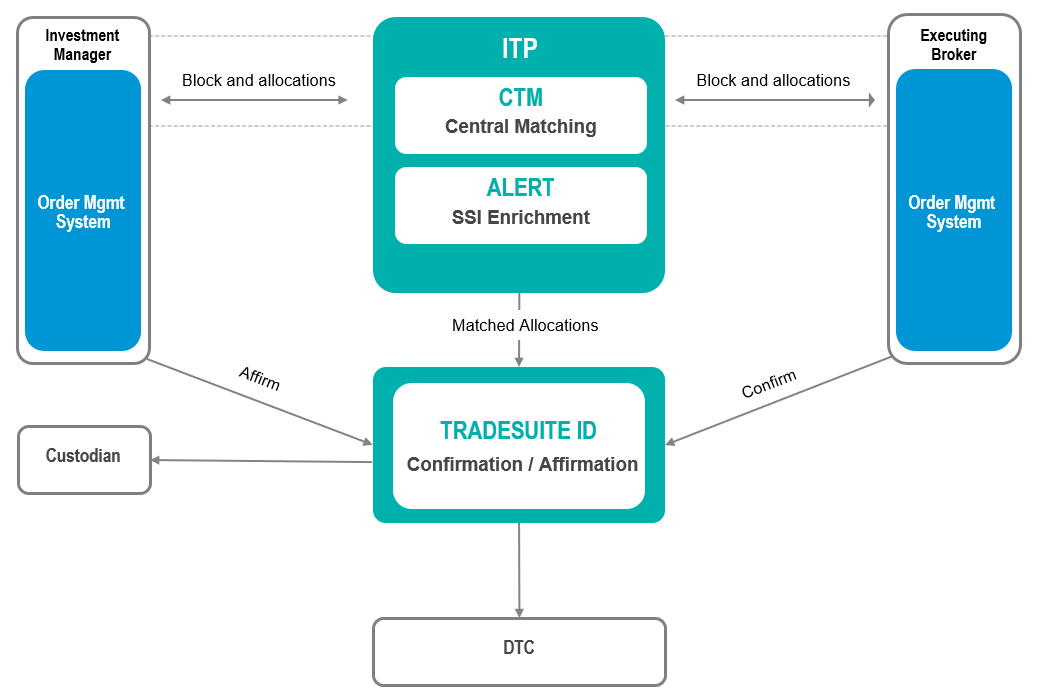

DTCC's Institutional Trade Processing (ITP) service suite offers buy-side, sell-side and custodian firms an end-to-end straight-through processing solution for their trading activity.

Select a product below to learn more and access resources to help you mazimize your use of the service. To learn more about the release schedule for all ITP products, please access our ITP Client Roadmap.

Welcome! In this section of the Learning Center you will find resources to support your use of the ALERT® service to create your own Standing Settlement Instructions and to view those of your counterparty.

To find the content you need, either use the Search field, view the relevant topics below or browse all learning content from Resources.

Remember to log in to see all content.

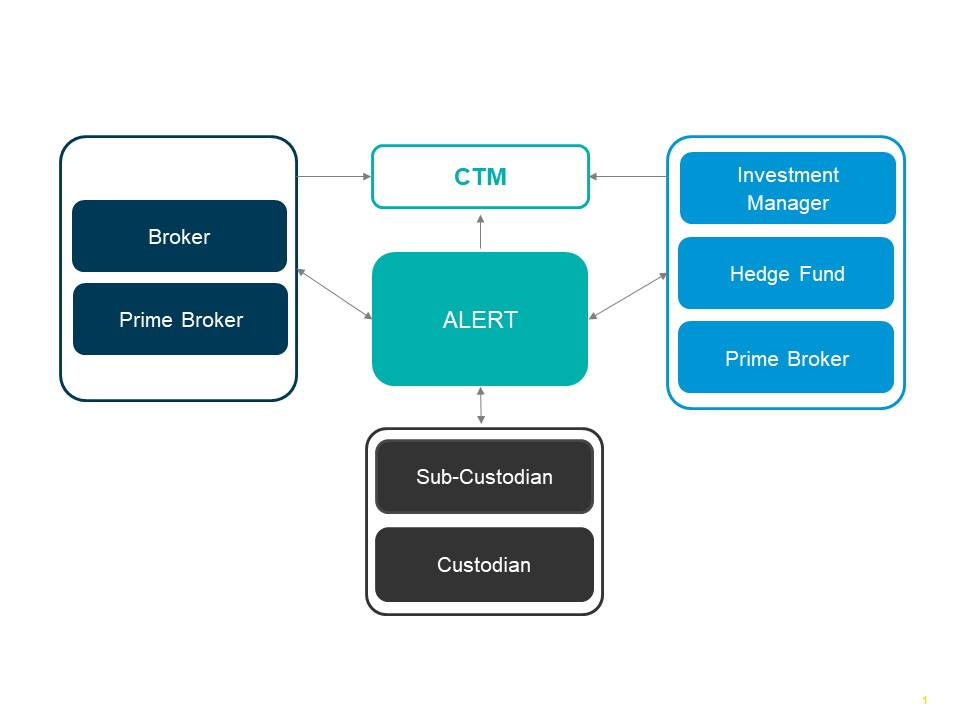

The ALERT® platform is the industry’s largest and most compliant online global database for the maintenance and communication of account and standing settlement instructions (SSI), enabling a global community of investment managers, brokers/dealers and custodian banks to share account and SSI data accurately and automatically.

This overview section is aimed at those getting started with the ALERT product family. You can explore the ALERT services either by Role, further down the page, or by Product offering, under the Related Content section. You can find Technical documentation to support your implementation and set-up at the bottom of this page.

For functionality and SSI data set-up, follow the SSI Management menu and select the path most appropriate to your needs.

ALERT Services by Role

How your team interacts with ALERT will depend on your role and the ALERT feature you elect to utilise. Learn more about the different flavours of ALERT, by clicking the appropriate section, below:

ALERT allows buy-side clients to set up or edit accounts and maintain the SSIs associated with those accounts. Buy-side clients can link accounts to a set of existing instructions they have created using models, or SSI maintenance may be handled by Global or Regional Custodians by both the web service as well as by GC Direct, for those (GC) Direct-enabled global custodians and prime brokers. Account access can be restricted to only those broker-dealers with whom you actively trade, and your permissioned broker-dealers are notified of your instruction changes by the electronic Alerting process within ALERT. You can also retrieve broker-dealer SSIs online when needed.

ALERT features relevant to buy-side clients are: ALERT Web, Global Custodian Direct, ALERT ASSIsT, and ALERT Plus.

Find more indepth guidance for each ALERT feature from the links or Related Content Section on this page.

ALERT facilitates the communication of a wide range of settlement instructions to our sell-side clients who receive updates to settlement instructions from the buy-side via an electronic Alerting process within ALERT. Sell-side clients also retrieve settlement instructions on a trade-by-trade basis through enrichment within the Institutional Trade Processing (ITP) service suite. To expedite processing, the sell-side can link the buy-side's account codes (Access Codes) to their own internal account numbers (Broker Internal Accounts or BIAs) which ensures the retrieval of Alerts that pertain to those specific buy-side accounts of interest.

ALERT features relevant to sell-side clients are: ALERT Web and ALERT Direct.

Find more indepth guidance for each ALERT feature from the Related Content Section on this page.

With ALERT GC Direct, custodian banks and prime brokers can electronically manage settlement instructions through ALERT on behalf of their buy-side clients. This enhanced custodian and prime broker access enables them to become the owner and maintainer of SSIs using dedicated ISO 20022 compliant messages. The automated exchange of SSIs between a custodian’s central repository and the ALERT host ensures sensitive settlement data is secure. Future effective SSI updates can also be managed so custodian banks and prime brokers can proactively update their buy-side clients of pending market changes.

ALERT features relevant to custodian banks and prime brokers are: ALERT Global Custodian Web, ALERT Global Custodian Direct for Global Custodians, ALERT Global Custodian Direct for Regional Custodians, and ALERT Plus for Global Custodians.

Find more indepth guidance for each ALERT feature from the Related Content Section on this page.

Technical Guidance

The below documents are key resources for any ALERT initial implementation.

Find service-specific indepth technical guidance by selecting your required service from the Related Content Section on this page.

{docmanlist orderByOrder 1276}

The below documents outline the most recent ALERT enhancements:

{docmanlist orderByOrder 1571}

User and product management is instrumental in the successful adoption and implementation of ALERT. Find out what each entails below, and where to find guidance and support:

The Product Administrator plays an important role in administering your organization’s access rights and profiles for ITP products, liaising between your organization and the DTCC. Their responsibilities include:

- Managing users

- Managing other product administrators

- Updating product profiles

- Monitoring existing requests

Learn more about Product Administrators and their administration tool, Service Central.

Data Authentication (DA) is the process that the ALERT platform uses to authenticate the entry, deletion, and modification of ALERT platform data. It can be used by both broker/dealer and investment manager client types and can be applied to the following data types:

| Data Type | Broker/ Dealer | Investment Manager |

| Account Settlement Instructions | X | |

| Broker Access | X | |

| General Account | X | |

| Market Activation | X | |

| Model Settlement Instructions | X | X |

By default, Model and Account Settlement Instruction changes will require a minimum of two levels of Data Authentication for F/X, Cash and Derivative instructions. Clients can then choose to apply Data Authentication to other data types. The levels of authentication are defined as follows:

- None

- 2 levels (Creation + Approval)

- 3 levels (Creation + Approval + Authorization)

Clients can therefore set up their users to be Creators, Approvers and/or Authorizers, however the same user can not complete 2 subsequent steps in the Data Authentication process. Using Manage My Services, individuals who have been designated as a Data Authentication Administrator controls the roles applied to other users and the number of levels of authentication required.

DTCC highly recommends that you promptly action any pending items in your Data Authentication queues.

For more in-depth information about how to access Service Central, visit ITP Cross-Product - ServiceCentral.

Data Authentication Functionality

The following video provides further details on how to manage and use the Data Authentication functionality:

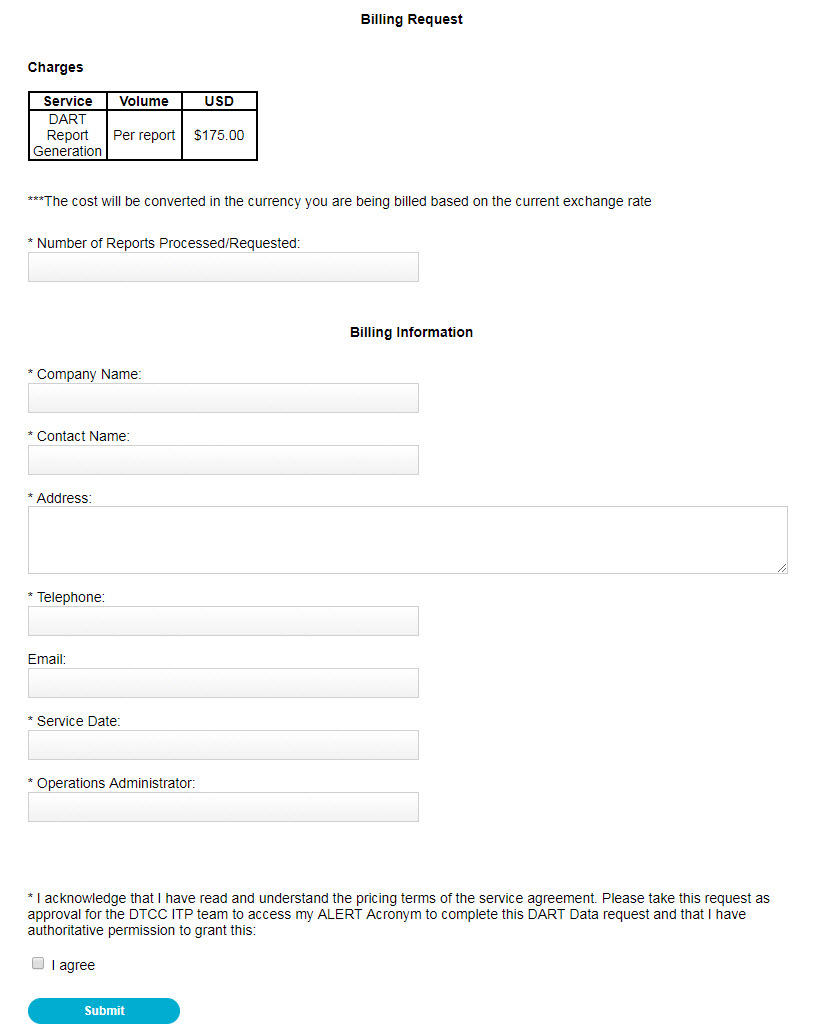

DART Requests

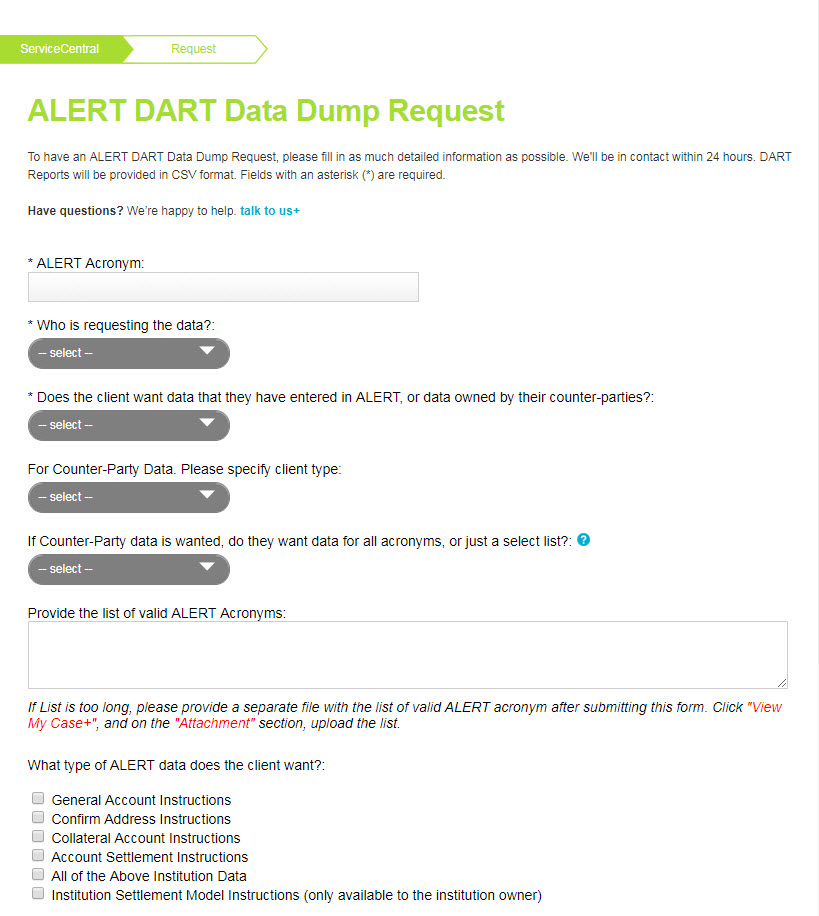

All ALERT client types who require an extract of data from ALERT can submit a request for a DART report, output in the format of a Microsoft Excel file. Please note this service is chargeable and you will be requested to provide billing details when submitting a request.

Full details on how to request a DART report are below, including which fields to populate depending on the type of data you are requesting. You can also review the ALERT Data Search reports documentation.

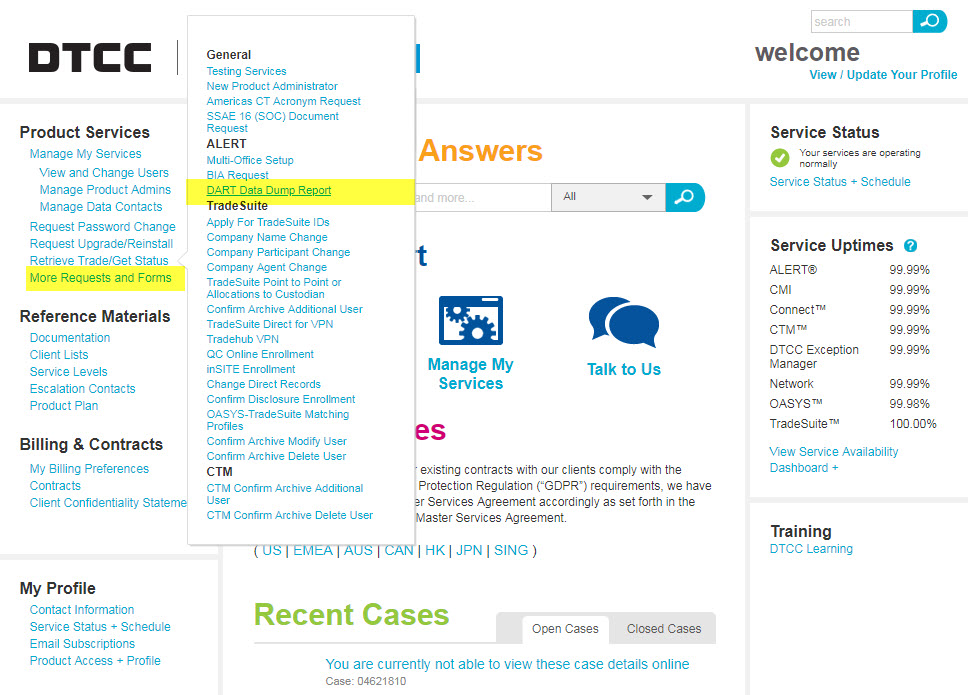

1. Log in to ServiceCentral. If you don't already have an account you can register for one.

2. Under Product Services select More Requests and Forms, followed by DART Data Dump Report.

3. In the ALERT Acronym field, enter your own ALERT acronym.

4. Depending on the type of data you want to be included in the extract, populate the fields below as shown in the table. When requesting counterparty data, you can select all acronyms or specify those that you require access to.

| Who is requesting the data? | Do you want your own data or your counterparties data? | If counterparty data, what type of client are they? |

What type of ALERT data is required? (select the relevant check box) |

|

| Scenario 1: Broker requesting IM accounts | Broker | Counterparty | Institution | General Account Instructions |

| Scenario 2: Broker requesting IM SSIs | Broker | Counterparty | Institution | Account Settlement Instructions |

| Scenario 3: Broker requesting own SSIs | Broker | Own | N/A | Institution Settlement Model Instructions |

| Scenario 4: IM requesting their own accounts | Institution | Own | N/A | General Account Instructions |

| Scenario 5: IM requesting their own SSIs | Institution | Own | N/A | Account Settlement Instructions |

| Scenario 6: IM requesting Broker SSIs | Institution | Counterparty | Broker | Institution Settlement Model Instructions |

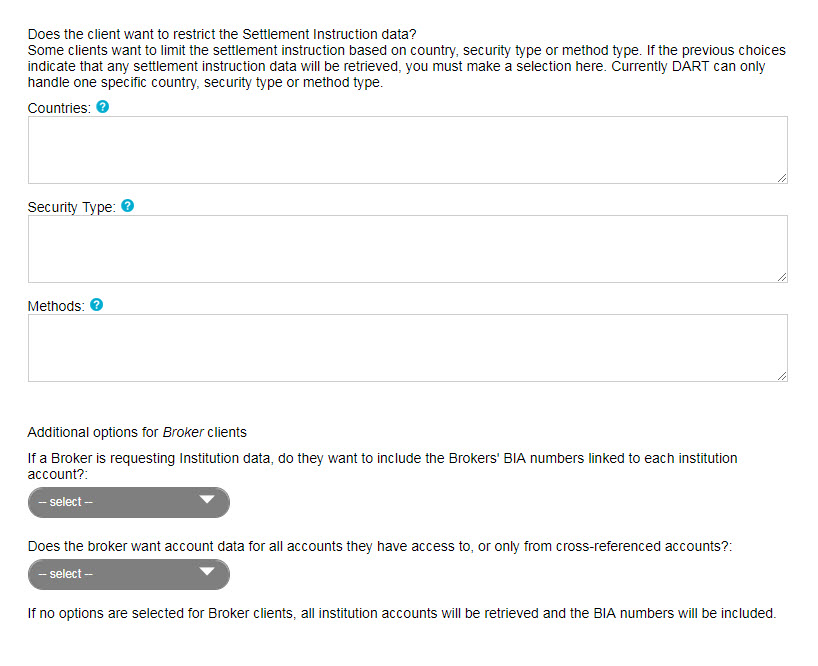

5. For Settlement Model Instruction requests, if you want to restrict the data extract to certain Country, Security or Method types, please specify.

6. If you are a broker requesting counterparty data (Scenarios 1 and 2), answer the additional questions under Additional options for Broker clients. If you want to include BIAs, the DART report will include your BIA number in the data extract where one exists. If you only want to include cross-referenced accounts, select Cross-referenced Account only. Otherwise, choose All Institution Accounts.

7. Complete all billing information.

8. Once all information is complete, click Submit. You will receive a confirmation email from DTCC Client Operations confirming your request.

Welcome! In this section of the Learning Center you will find resources to support broker/dealer users of inSITE who need to upload their disclosures and investment manager users who want to view the broker/dealer disclosures linked to their trade confirms. To find the content you need, either use the Search field, view the relevant topics below or browse all learning content from Resources.

Remember to log in to see all content.

Welcome! In this section of the Learning Center you will find the resources you need to maximize your use CTM, our strategic central matching platform. To find the content you need either use the Search field or navigate to your area of interest to learn more about how to integrate CTM into your back/middle-office infrastructure or use the CTM UI to manage your matching exceptions.

Remember to log in to see all content.

Welcome! In this section of the Learning Center you will find the resources you need to maximize your use of TradeSuite ID, our trade confirmation system supporting the U.S. equity and fixed income markets. To find the content you need either use the Search field or navigate to your area of interest to learn more about how TradeSuite ID can be used as part of the ITP no-touch workflow.

Remember to log in to see all content.

TradeSuite ID is the U.S. domestic industry-standard post trade processing service automating the electronic distribution of trade details between counterparties to facilitate electronic settlement and regulatory compliance. It can be used as a standalone service by both brokers and investment managers, or as a part of the ITP 'No-touch' workflow for U.S. domestic trades.

To learn more about the combined workflow between CTM and TradeSuite ID, please visit CTM Workflows - US-Specific Workflows.

To learn more about using the features and functionality of TradeSuite ID, including using the web-based user interface, please access the resources available under Related Content.

Welcome! In this section of the Learning Center you will find resources to support your use of archival services to retrieve archived trade records from both the CTM and TradeSuite ID services.

To find the content you need, either use the Search field, view the relevant topics below or browse all learning content from Resources.

Remember to log in to see all content.

Welcome! In this section of the Learning Center you will find the resources you need to maximize your use of the Settlement Instruction Manager service.

To find the content you need either use the Search field or navigate to your area of interest to learn more about how Settlement Instruction Manager can be used as part of the ITP no-touch workflow.

Remember to log in to see all content.

Welcome! In this section of the Learning Center you will find the resources you need to maximize your use of ITP Data Analytics. To find the content you need either use the Search field or navigate to your area of interest to learn more about how to use Data Analytics to undestand the operational performance of your ITP services.

Remember to log in to see all content.

Welcome! In this section of the Learning Center you will find resources that support features, functionality and best practices that apply across multiple ITP products and services. To find the content you need, either use the Search field, view all relevant topics below or navigate to all available content by accessing Resources.

Remember to log in to see all content.

Welcome! In this section of the DTCC Learning Center you will find the resources that you need to maximize your use of DTCC’s Equities Clearing offerings. To find the content you need, either use the Search field or select a product below to access user guides, file specifications, video tutorials, FAQs, and more. Log in to learn more about all of the Equities Clearing products and services.

DTCC clears and settles virtually all broker-to-broker equity, listed corporate and municipal bond, and unit investment trust (UIT) transactions in the U.S. equities markets. DTCC advances new initiatives, drives development of products and services that mitigate risk, reduces costs, and enhances processing efficiencies for market participants.

The Equities Clearing products and services assist you from pre-trade to trade capture, National Securities Clearing Corporation (NSCC) trade processing, and settlement, either through DTC or other settlement locations. NSCC provides clearing, settlement, risk management, central counterparty services, and guarantees completion for certain transactions for virtually all broker-to-broker trades involving equities, corporate and municipal debt, American depository receipts, exchange traded fund (ETF), and unit investment trust (UIT) transactions in the U.S. equities markets.

In the following NSCC trade flow, hover over the product name in orange for a brief desciption, and then click an item to learn more about that Equities Clearing product or service.

The National Securities Clearing Corporation (NSCC), a subsidiary of DTCC, provides clearing, settlement, risk management, central counterparty services, and guarantees completion for certain transactions for virtually all broker-to-broker trades involving equities, corporate and municipal debt, American depository receipts, exchange traded fund (ETF), and unit investment trust (UIT) transactions in the U.S. equities markets. DTCC advances new initiatives and drives product and service development that mitigate risk, reduce costs, and enhance processing efficiencies for market participants.

Welcome! In this section of the DTCC Learning Center you will find the resources that you need to maximize your knowledge of NSCC Risk Management.

Welcome to the ETF Processing section of the Learning Center! Through our Exchange Traded Fund (ETF) process, you can safely and securely move ETFs and their underlying securities through the settlement process for clearing through NSCC. This automated process generates clearance instructions that are validated through Universal Trade Capture (UTC). Locate the content that you need by using Search to filter or access Resources to navigate to all of the ETF content.

Welcome to the CMU Division section of the Learning Center! Corporate, Municipal, and UIT (CMU) is a secure, trade entry management tool that incorporated robust search capabilities, statistical reporting, and exception processing. Locate the content that you need by using Search to filter or access Resources to navigate to all of the CMU content.

Welcome to the Universal Trade Capture (UTC) section of the Learning Center! The UTC service validates and reports equity transactions that are submitted to NSCC throughout the trading day by exchange or qualified special representatives (QSRs) that are NSCC members. Locate the content that you need by using Search to filter and view all relevant content or access Resources to navigate to all of the UTC content.

Welcome to the Consolidated Trade Summary (CTS) section of the Learning Center! The CTS system defines the expected settlement path for each transaction received by the Universal Trade Capture (UTC) system as eligible for CNS® or non-CNS. Locate the content that you need by using Search to filter or access Resources to navigate to all of the CTS content.

Welcome to the CNS® section of the Learning Center! The CNS system is the core netting, allotting, and fail-control engine operated by NSCC. It is the standard for clearing and settling equities, fixed income, and other eligible securities at DTC. Locate the content that you need by using Search to filter or access Resources to navigate to all of the CNS content.

Welcome to the Obligation Warehouse section of the Learning Center! Obligation Warehouse provides an automated service for matching obligations submitted by members for U.S. securities classified as equities, corporates, or unit investment trusts (UITs). In addition, Obligation Warehouse receives matched trades through Consolidated Trade Summary (CTS). Locate the content that you need by using Search to filter or access Resources to navigate to all of the Obligation Warehouse content.

Welcome to the ACATS section of the Learning Center! The Automated Customer Account Transfer Service (ACATS) system automates and standardizes procedures for transferring assets in a customer account from one brokerage firm or bank to another. Locate the content that you need by using Search to filter or access Resources to navigate to all of the ACATS content.

Welcome to the Cost Basis Reporting Service (CBRS) section of the Learning Center! CBRS is an automated system that supports the transfer of cost basis information from one firm to another for any asset transfer. Locate the content that you need by using Search to filter or access Resources to navigate to all of the CBRS content.

Welcome to the DTCC Limit Monitoring section of the Learning Center! DTCC Limit Monitoring is a risk mitigation tool that leverages, in near real-time, the largest aggregate equity trading information in the industry to bring unprecedented post-trade insights to our client. Locate the content that you need by using Search to filter or access Resources to navigate to all of the DTCC Limit Monitoring content.

Welcome to the SFT Clearing section of the Learning Center! The Securities Financing Transaction (SFT) Clearing service provides central clearing for equity lending and borrowing transactions, leveraging the clearing capabilities, risk management, and efficient infrastructure of the DTCC equities clearing subsidiary, National Securities Clearing Corporation (NSCC). Locate the content that you need by using Search to filter or access Resources to navigate to all of the SFT Clearing content.

Welcome! In this section of the DTCC Learning Center you will find the resources you need to maximize your use of DTCC’s Fixed Income Clearing offerings. To find the content you need, either use the Search field or select a product below to access user guides, file specifications, video tutorials, FAQs, and more.

Remember to log in to see the most available content.

US Government Securities is the largest sector of the fixed income market. The GSD Learning Center is designed as an educational resource to better equip Fixed Income Clearing Corporation's (FICC's) Government Securities Division (GSD) Members and stakeholders with tools needed to use GSD's products and services.

The DVP Service offered by FICC’s Government Securities Division (GSD) supports and facilitates the submission, comparison, risk management, netting, and settlement of trades executed by its Members in the U.S. Government securities market.

The GCF Repo® Service enables dealers to trade general collateral repos, based on rate, term, and underlying product, throughout the day without requiring intra-day, trade-for-trade settlement on a Delivery-versus-Payment (DVP) basis.

To participate in the GCF Repo® Service, dealers must be netting members of FICC’s Government Securities Division (GSD).

Dealers execute GCF Repos through Inter-Dealer Brokers, who are also Members of GSD on an anonymous or “blind” basis. Brokers are then required to submit trade data on GCF Repo transactions to FICC shortly after trade execution. Upon receipt of the data, FICC immediately reports the transaction details to the dealers. The most recent trades and position information are displayed simultaneously. Position information is available both at the individual CUSIP level and at the cumulative, overall level.

When GSD receives the trade data from the locked-in trade source, it becomes the settlement counterparty to each dealer and guarantees settlement of the transactions. GCF Repo transactions are settled on a tri-party basis, which requires dealer participants to have an account with the participant clearing bank(s).

Eligible Collateral Types

Collateral currently accepted for GCF Repos include:

- U.S. Treasury Bills, Bonds and Notes,

- U.S. Treasury Inflation Protected Securities (TIPS),

- Fixed-and-adjustable-rate mortgage-backed securities issued by Fannie Mae, Ginnie Mae and Freddie Mac,

- Non-mortgage backed securities issued by government-sponsored enterprises, such as the Federal Home Loan Bank, Federal Farm Credit Banks and Federal Home Loan Mortgage Corporation (Freddie Mac), and

- STRIPS (STRIPS are U.S. Treasury and agency securities that have had the interest-payment coupons separated or “stripped” from the principal, creating zero-coupon securities and separate payment securities from what was originally a single Treasury bond or note).

FICC’s Sponsored Service allows certain Netting Members to sponsor, as Sponsoring Members, eligible legal entities, as Sponsored Members, into FICC/GSD Membership. A Sponsoring Member is permitted to submit to FICC on behalf of its Sponsored Members, transactions in eligible securities for comparison and novation.

MBSD's mission is to reduce the costs and risks associated with trading in the agency mortgage-backed securities market. To accomplish this mission, MBSD provides high-quality and value-added services that are driven by the needs of its members and industry participants.

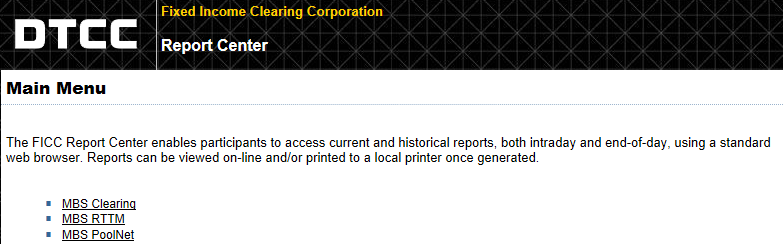

When viewing MBSD Report Center, several links or menus can be seen: MBS Clearing, MBS RTTM, and MBS PoolNet. To help our clients better understand the reports produced in these categories, we have created several report guides which explain the purpose of each report, the formats in which it is available, its report headers and its data elements. For each of the menus in MBSD Report Center, there is an associated guide. In addition, the MBSD Operational Novation Reports Guide specifically details the reports most relevant to MBSD Novation.

MBSD Report Center Main Menu

Risk management is the foundation for MBSD’s ability to guarantee settlement, as well as the means by which MBSD protects itself and its Members from the risks inherent in the settlement process, including the possibility of a Member default.

Real-Time Trade Matching (RTTM®) enables dealers, brokers and other market participants to automate the processing of fixed income securities trades throughout the trading day.

The MBSD RTTM® system provides access to users who are looking to perform MBS processing for Trade Matching, TBA Netting, Do-Not-Allocate, Pool Netting, and Clearance tasks activities.

The Real-Time Trade Matching System (RTTM) for Mortgage-Backed Securities (MBS) is a product of the Fixed Income Clearing Corporation's Mortgage-Backed Securities Division (MBSD). RTTM is a trade-entry/management tool that increases the efficiency of trade operations yet reduces your firm’s overall risk. All activity is validated and matched in real-time. From trade submission to comparison, processing time is reduced to a fraction of what it had taken in the past.

Note:

Many of the screens and processes in the below sections refer to the previous RTTM system. These materials have been left on the Learning Center as most of the workflow has remained the same. New training assets will be rolled out over time to replace the dated reference material.

The Electronic Pool Notification section defines EPN, explains how to access the systems required to use it, explains how to find and use its reports, and provides technical information for its use.

EPN is intended for all firms that are engaged in the MBS pool allocation and notification process, including broker/dealers, inter-dealer brokers, commercial banks, government sponsored enterprises (GSEs), mortgage originators, insurance companies, investment companies, investment managers/advisors, mutual funds, trust companies, pension funds, international organizations, and organizations that act as principal to the underlying trade and maintain direct FICC accounts. Firms do not have to be members of FICC’s MBS Division clearing services in order to use EPN.

The topics in the EaSy Pool section of the MBSD Learning Center provide step-by-step instructions about how to use the Electronic Pool Notification (EPN) EaSy Pool (ESP) service. You can submit all original notification (ON), don't know (DK), cancel and correct (CC), and cancel (CX) messages through EaSy Pool. This guide assumes a general knowledge of mortgage-backed securities. This content is intended for information technology professionals, business analysts, and others who are responsible for implementing or operating EaSy Pool.

EaSy Pool is a messaging service that enables you to communicate with your counterparties. It provides a formatted data-entry and display facility for Electronic Pool Notification (EPN) message entry, message display, reporting, receipt of messages, and administration.

To access EaSy Pool, ensure that you are using EaSy Pool with an existing access coordinator (AC) set up with DTCC or FICC. Verify that you have the correct permissions.

Within the EaSy Pool section you can learn about:

- Accessing EaSy Pool

- How to navigate the EaSy Pool Home page

- Transaction Management

- Report Center

- EaSy Pool Business Administration

This section includes detailed descriptions of MBS EPN Reports. Each sample report is introduced with a definition table that lists the Purpose, Access, Clearing Fundamentals Cross-Reference, and Timing requirements. Reports can be printed only from the Report Center.

Also included in this section are various MBS code tables (e.g., Agency codes, DK Reason codes, and Trade Type codes).

It is assumed that you have a general knowledge of mortgage-backed securities processing. Please direct all questions regarding this information to the FICC Operations Department.

The Pool Substitution message provides members with an efficient method of transmitting Pool Substitutions to their allocation counterparties. The Pool Substitution message is structured to create a relationship between both the canceled and substituted pools. Canceled lots or pools are followed by substituted lots or pools of the same value (within variance).

The EPN Pair-Off section of the Learning Center provides you with access to learning resources to assist you with MBSD's Pair-Off Service.

Cash Settlement is a daily automated process of settling cash credit and debit amounts between members and FICC. To provide this service, FICC employs the Federal Reserve Bank’s National Settlement Service (NSS) to debit and credit net settlement obligations at the settling bank level of MBSD members.

Welcome! The Asset Services section of the DTCC Learning Center is where you will find the resources you need to maximize your use of DTCC’s Asset Services offerings. Use Infographics like the one below, Quick Links, Recommended Resources, the Resources tab, and Search to make your learning journey a rewarding one. Remember to login to see all available content.

The Asset Services Learning Center is dedicated to helping you get the most from DTCC's Underwriting Services, Securities Processing solutions (such as Custody) and other Asset Services such as Corporate Actions Processing, Global Tax Services and Issuer Services. You'll also find Agent Services resources to assist FAST Agents in the Asset Services Learning Center.

Be sure to:

- Interact with the infographic below to learn more about these products and services.

- Scroll down to watch the DTC Loss Allocation Overview eLearning

- Scroll down for access to all Asset Services Products & Services and links to their Featured Content.

Hover over products and services in the image below to learn more.

The Resources tabs in the Asset Services section of this Learning Center provide access to all learning resources (documents, videos, etc.) available for a service and its sub-products. For a view pre-filtered to show learning resources specific to a product, view the Resources tab for that product.

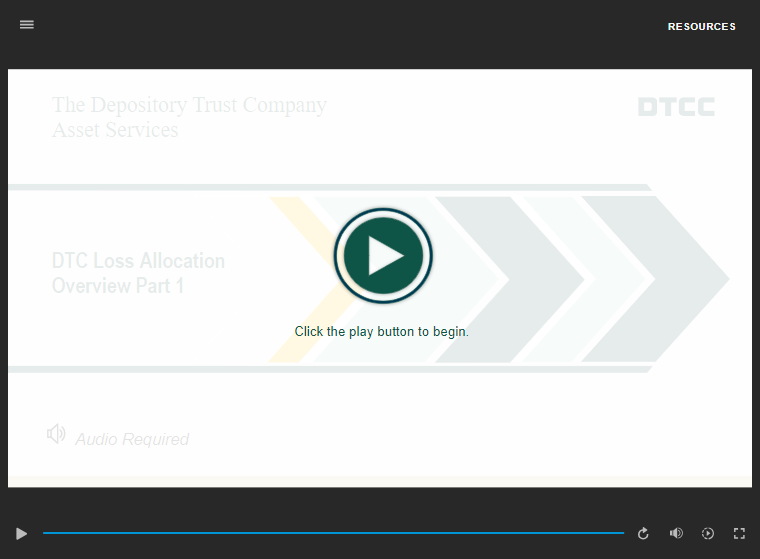

DTC Loss Allocation Overview

| DTC Loss Allocation Overview - Part 1 | DTC Loss Allocation Overview - Part 2 |

|

|

| Click the image above to view Part 1 | Click the image above to watch Part 2 |

| Learn about DTC's Loss Allocation practices and how they would be applied in the event of (hypothetical) single-or-multiple-Participant default or Non-Default Loss events by watching Parts 1 and 2 of the DTC Loss Allocation Overview eLearning, also available via the Resources tab at the top of this page. | |

Welcome! In this section of the DTCC Learning Center you will find the resources you need to maximize your use of DTCC’s Underwriting Services offerings. You can use Search, the Resources tab (includes filters to help narrow your search), and Quick Links to learn more.

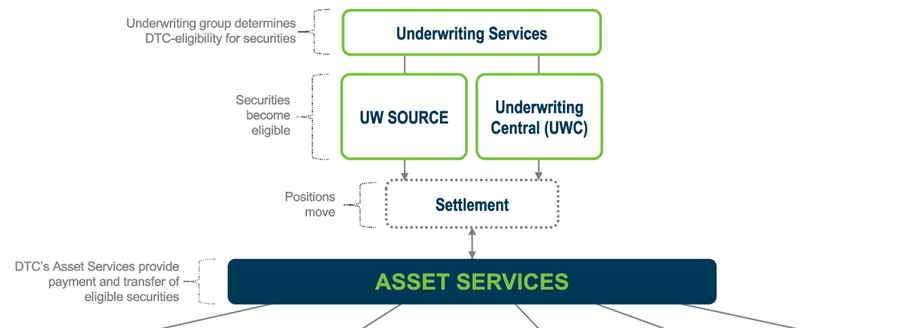

Underwriting is the entry point for depository and book-entry transfer services at The Depository Trust Company (DTC). UW SOURCE is the system that gives you access to Underwriting functions. The Underwriting Central (UWC) application integrates data validation, electronic vaulting, and e-signatures to create a better experience for brokers and issuers. It improves upon UW SOURCE with a more streamlined user interface, fewer operational touch-points, improved data quality, and added transparency into the DTC eligibility life cycle.

Underwriting is the entry point for depository and book-entry transfer services at The Depository Trust Company (DTC). UW SOURCE is the system that gives you access to Underwriting functions. The Underwriting Central (UWC) application integrates data validation, electronic vaulting, and e-signatures to create a better experience for brokers and issuers. It improves upon UW SOURCE with a more streamlined user interface, fewer operational touch-points, improved data quality, and added transparency into the DTC eligibility life cycle.

The Resources tab at the top of this page includes items related to Underwriting Services in general, but not those specific to the UW SOURCE or Underwriting Central (UWC) applications.

- For a view of resources pre-filtered to show only those specific to UWC, see the Resources tab at the top of the Underwriting Central (UWC) page (see also Underwriting Services menu).

- For a view of resources pre-filtered to show only those specific to UW SOURCE, see the Resources tab at the top of the UW SOURCE page (see also Underwriting Services menu). These views can then be filtered to show resources by topic, format (document, video, etc.), and sorted by title, date of publication, etc.

Underwriting Services and Asset Services - Flow Diagram (excerpt)

Welcome to the Underwriting Central (UWC) section of the Asset Services Learning Center, a space dedicated to providing training resources and answering questions about using the Underwriting Central platform.

Welcome! In this section of the DTCC Learning Center, you can locate the resources that you need to maximize your use of DTCC’s UW SOURCE. Use Quick Links, the UW SOURCE Resources tab (utilize filters to help narrow returned results), and Search to learn more.

Welcome! In this section of the DTCC Learning Center you will find the resources you need to maximize your use of DTCC’s Securities Processing services. Use Quick Links, the Securities Processing Resources tab (utilize filters to help narrow returned results), and Search to learn more.

Welcome to the Securities Processing section of this Learning Center. Through its suite of Securities Processing services The Depository Trust Company (DTC) provides its participant firms a range of safekeeping and processing services for various types of securities. Securities Processing services deliver efficient and cost-effective solutions for deposits, withdrawals, electronic direct registration and custody.

The Custody Service is a unified service that allows you to perform physical deposits, withdrawals and more. See the Custody Service Overview section below to access links to available Custody Service learning solutions. You may also wish to view the spreadsheet Custody Conversion Checklist (151 KB) to track your readiness for using the Custody Service. This spreadsheet outlines the sequence of events that must take place, as well as the party or parties responsible for each step.

Custody Service Overview

Use the links below to begin learning more about Custody Services:

Custody Service

Explains benefits, asset eligibility and components of the Custody Service. Includes information about Restricted Deposits/Transfers and Custody Reorg.

Custody Eligibility

Includes videos demonstrating the Custody Eligibility system which allows you to obtain Custody CUSIPs through self-service, speeds your ability to make deposits quickly, and promotes straight-through processing of Custody deposits.

Custody in PBS

Learn about using the Custody functionality in the Participant Browser System (PBS).

Custody Safekeeping

These videos provide in-depth explanations of the deposit, withdrawal, transfer and inquiry aspects of the Custody Safekeeping functionality.

New York Window

Learn about processing receives and delivers, as well as viewing and cancelling physical settlement items.

Welcome! In this section of the DTCC Learning Center you will find the resources you need to maximize your use of DTC’s Custody Services. Use Quick Links, the Custody Service Resources tab (utilize filters to help narrow returned results), and Search to learn more.

Welcome! In this section of the DTCC Learning Center you will find the resources you need to maximize your use of DTCC’s Corporate Actions Processing solutions. Use Quick Links, the Corporate Actions Processing Resources tab (utilize filters to help narrow returned results), and Search to learn more.

Welcome to the Corporate Actions Processing section of this Learning Center. The Corporate Actions Processing section contains learning resources about the Depository Trust Company's (DTC) wide array of services for processing corporate action events for approximately 1.3 million active DTC-eligible securities. These services include announcing details of upcoming events and providing participants with information about their entitlements, accepting and acting on their instructions, and collecting, allocating, and reporting payments across various corporate action event types, including distributions, redemptions, and reorganizations. Use the Corporate Actions Processing menu at left to learn more about:

Welcome to the Corporate Actions Processing section of this Learning Center. The Corporate Actions Processing section contains learning resources about the Depository Trust Company's (DTC) wide array of services for processing corporate action events for approximately 1.3 million active DTC-eligible securities. These services include announcing details of upcoming events and providing participants with information about their entitlements, accepting and acting on their instructions, and collecting, allocating, and reporting payments across various corporate action event types, including distributions, redemptions, and reorganizations. Use the Corporate Actions Processing menu at left to learn more about:

CA Web

- Learning content specific to the Corporate Actions browser-based user interface (CA Web), from announcements through the entire lifecycle, and links to learning resources such as user guides, help files, eLearning, FAQs and other supporting documentation.

ClaimConnectTM

- User guides, eLearning and other resources supporting the ClaimConnect™ service, a solution to the industry's challenges in handling claims that may not be tracked by DTC (and eliminates the need for dedicated departments and e-mail reconciliation).

Distributions

- DTC’s Corporate Actions Processing Service for Distributions provides full lifecycle processing, including announcing details of upcoming events, providing participants with information about their entitlements, accepting and acting on their instructions, and collecting, allocating and reporting payments.

Dividend and Income Processing

- DTC's Dividend services include announcing, collecting, allocating and reporting dividend, interest and certain principal payments on behalf of its participants with securities in DTC custody. Includes resources related to CTAS, Interim Accounting and PUT Bonds.

ISO 20022 Messaging

- Resources related to ISO 20022, an international messaging standard that simplifies global business communication by creating a common language for financial information.

Redemptions

- DTC’s Corporate Actions Processing Service for Redemptions provides full lifecycle processing, including announcing details of upcoming events, providing participants with information about their entitlements, and collecting, allocating, and reporting payments.

Reorg

- DTC’s Corporate Actions Processing Service for Reorganizations provides full lifecycle processing, including sourcing and announcing the details of upcoming events, accepting and acting on instructions, and collecting, allocating, and reporting on the resulting entitlements.

Welcome! In this section of the DTCC Learning Center you will find the resources you need to maximize your use of DTCC’s Corporate Actions Web application. Use Quick Links, the CA Web Resources tab (utilize filters to help narrow returned results), and Search to learn more.

The Corporate Actions Web enables clients to manage the lifecycle of corporate action events by searching for corporate action event announcements, submitting instructions, and viewing entitlements and allocations using various dashboard overviews. Here you'll find learning content specific to CA Web such as user guides, help files, eLearning, FAQs and other supporting documentation. Be sure you login and utilize the Resources tab at the top of this page to access content related to:

The Corporate Actions Web enables clients to manage the lifecycle of corporate action events by searching for corporate action event announcements, submitting instructions, and viewing entitlements and allocations using various dashboard overviews. Here you'll find learning content specific to CA Web such as user guides, help files, eLearning, FAQs and other supporting documentation. Be sure you login and utilize the Resources tab at the top of this page to access content related to:

- CA Web Announcements - including

- viewing announcements,

- the CA Web Distributions tab,

- the CA Web Redemptions tab,

- the CA Web Reorganizations tab,

- Record Detail, and

- Event and Sub-Event Types

- CA Web Search

- CA Web Settlement Information - including

- the CA Web Security Position Tab, and

- the CA Web Settlement Activity Tab

- CA Web U.S. Tax Information

Note: For information about Distributions, Redemptions and Reorg functionality in CA Web, be sure to access those areas within the Corporate Actions Processing section of the Learning Center.

Recommended Resources

- CA Web Help

The CA Web Help, includes information for Distributions and Redemptions and thoroughly explains the CA Web interface and functionality. This is where you'll find the latest and most up-to-date information about CA Web and we recommend it as both the place to start and as a comprehensive learning solution. -

pdf

Provisioning Access and Roles to CA Web Users

(658 KB)

This guide for Super Access Coordinators/Access Coordinators describes how to create a CRS profile, how to provide the profile with access, and what the possible roles are in CA Web.

We recommend you begin by reviewing the CA Web User Guide as it explains all aspects of the Corporate Actions Web system.

Welcome! In this section of the DTCC Learning Center you will find the resources you need to maximize your use of ClaimConnectTM. Use Quick Links, the ClaimConnectTM Resources tab (utilize filters to help narrow returned results), and Search to learn more.

Welcome! In this section of the DTCC Learning Center you will find resources related to DTC's Corporate Actions Processing Service for Distributions and CA Web. Use Quick Links, the Distributions Resources tab (utilize filters to help narrow returned results), and Search to learn more.

DTC’s Corporate Actions Processing Service for Distributions provides full lifecycle processing, including announcing details of upcoming events, providing participants with information about their entitlements, accepting and acting on their instructions, and collecting, allocating and reporting payments.

DTC’s Corporate Actions Processing Service for Distributions provides full lifecycle processing, including announcing details of upcoming events, providing participants with information about their entitlements, accepting and acting on their instructions, and collecting, allocating and reporting payments.

The Distributions service includes processing events such as cash and stock dividends, principal and interest (P&I), capital gain distributions, return of capital, spin-offs, stock splits, and other events that arise from the servicing of the approximately 1.3 million active securities eligible at the depository.

P&I Cash Processing interacts with over 7,000 paying agents and issuers annually to facilitate the allocation of P&I entitlements to DTC participants on the scheduled payment date. For cash distributions, DTC provides additional services related to tracking for stock loan, repo, and fail transactions. DTC also provides the opportunity for its members to receive dividend reinvestment, payment in a foreign currency, and tax relief at-source for tax withheld on dividends paid on non-U.S. issues (See Global Tax Services fact sheets). Securities eligible for this service include foreign shares eligible at the depository but held in custody by DTC with local custodians and depositories. To learn more about Full Lifecycle Distributions Processing for Securites, be sure to visit the Distributions page on DTCC's corporate website (www.dtcc.com). You may also wish to visit the By-Laws, Rules and Procedures page for access to various Fee and Service Guides.

Here In the Distributions section of the Learning Center you'll find learning content specific to CA Web such as user guides, help files, eLearning, FAQs and other supporting documentation. Be sure you login and utilize the Resources tab at the top of this page to access content related to:

- CA Web Distributions - including

- the Distributions Dashboard,

- Distributions Instructions,

- Distributions Entitlements and Allocations, and

- Distributions Adjustments.

Note: For information about Redemptions and Reorg functionality in CA Web, be sure to access those areas within the Corporate Actions Processing section of the Learning Center. If you haven't already and you want to familiarize yourself with CA Web, be sure to visit the CA Web section.

Recommended Resources

-

pdf

CA Web User Guide

(20.65 MB)

The CA Web User Guide compiles the contents of the CA Web Help, including information for Distributions and Redemptions and thoroughly explains the CA Web interface and functionality. This is where you'll find the latest and most up-to-date information about CA Web and we recommend it as both the place to start and as a comprehensive learning solution. -

pdf

Provisioning Access and Roles to CA Web Users

(658 KB)

This guide for Super Access Coordinators/Access Coordinators describes how to create a CRS profile, how to provide the profile with access, and what the possible roles are in CA Web.

We recommend you begin by reviewing the CA Web User Guide as it explains all aspects of the Corporate Actions Web system.

Welcome! In this section of the DTCC Learning Center you will find resources related to DTC's use of ISO 20022 real-time MQ messaging and files for automated electronic communication with clients. Use Quick Links, the ISO 20022 Resources tab (utilize filters to help narrow returned results), and Search to learn more.

ISO 20022 is an international messaging standard that simplifies global business communication by creating a common language for financial information. DTC uses ISO 20022 real-time MQ messaging and files for automated electronic communication with clients. The ISO 20022 standard provides a modernized business model and platform that replaces legacy proprietary formats and files.

ISO 20022 is an international messaging standard that simplifies global business communication by creating a common language for financial information. DTC uses ISO 20022 real-time MQ messaging and files for automated electronic communication with clients. The ISO 20022 standard provides a modernized business model and platform that replaces legacy proprietary formats and files.

Corporate Actions Messaging Specifications for ISO 20022 are intended as an implementation overview for both technical and business experts. DTCC uses the ISO 20022 Corporate Actions Message format for its Corporate Actions Announcements, Entitlements and Allocations, Instructions and Meetings data.

The following resources may be accessed via the ISO 20022 Messaging Specifications page on DTCC's corporate website:

Standard Release (SR) message types in .zip archives:

- Business Application Header

- Announcements

- Entitlements and Allocations

- Elective Dividend Instructions

- Voluntary Reorganization Instructions

- Meeting Proxy

DTCC provides messaging specifications for the standard ISO 20022 message and when applicable, its proprietary Extension component.

The specification zip files contain the following folders, when applicable:

- Message Usage Guidelines in Excel format

- Message Usage Guidelines in .pdf format

- DTCC extension schemas

- ISO 20022 unrestricted schemas

Also available are the following ISO 20022 Messaging User Guides:

- Getting Started - Announcements & Data Model

- Lifecycle:

- Distributions (Entitlements and Allocations)

- Redemptions (Entitlements and Allocations)

- Reorganizations (Entitlements and Allocations)

- Instructions:

- Distributions

- Reorganizations

Other, publically available related resources can be found at the following locations:

- Corporate Action Data Dictionaries

- Automating Distributions Instructions for Elective Dividend Events

The information and links above are provided for your convenience. For additional ISO 20022 Messaging resources, see the ISO 20022 Messaging Resources tab.

Welcome! In this section of the DTCC Learning Center you will find resources related to DTC's Corporate Actions Processing Service for Redemptions and CA Web. Use Quick Links, the Redemptions Resources tab (utilize filters to help narrow returned results), and Search to learn more.

DTC’s Corporate Actions Processing Service for Redemptions provides full lifecycle processing, including announcing details of upcoming events, providing participants with information about their entitlements, and collecting, allocating, and reporting payments. The Redemptions service includes events such as full and partial calls, final paydowns, maturities, full and partial pre-refundings, partial defeasances, terminations, and other events that arise from the servicing of securities eligible at the depository. To learn more about Full Lifecycle Processing of Redemptions for Securites, be sure to visit the Redemptions page on DTCC's corporate website (www.dtcc.com). You may also wish to visit the By-Laws, Rules and Procedures page for access to various Fee and Service Guides.

DTC’s Corporate Actions Processing Service for Redemptions provides full lifecycle processing, including announcing details of upcoming events, providing participants with information about their entitlements, and collecting, allocating, and reporting payments. The Redemptions service includes events such as full and partial calls, final paydowns, maturities, full and partial pre-refundings, partial defeasances, terminations, and other events that arise from the servicing of securities eligible at the depository. To learn more about Full Lifecycle Processing of Redemptions for Securites, be sure to visit the Redemptions page on DTCC's corporate website (www.dtcc.com). You may also wish to visit the By-Laws, Rules and Procedures page for access to various Fee and Service Guides.

Here In the Redemptions section of the Learning Center you'll find learning content specific to CA Web such as user guides, help files, eLearning, FAQs and other supporting documentation. Be sure you login and utilize the Resources tab at the top of this page to access content related to:

- CA Web Redemptions includes:

- Redemptions Dashboard and Announcements

- Redemptions Advanced Search

- Redemptions Record Detail

- Redemptions Entitlements, Allocations and Adjustments

Note: For information about Distributions and Reorg functionality in CA Web, be sure to access those areas within the Corporate Actions Processing section of the Learning Center. If you haven't already and you want to familiarize yourself with CA Web, be sure to visit the CA Web section.

Recommended Resources

-

pdf

CA Web User Guide

(20.65 MB)

The CA Web User Guide compiles the contents of the CA Web Help, including information for Distributions and Redemptions and thoroughly explains the CA Web interface and functionality. This is where you'll find the latest and most up-to-date information about CA Web and we recommend it as both the place to start and as a comprehensive learning solution. -

pdf

Provisioning Access and Roles to CA Web Users

(658 KB)

This guide for Super Access Coordinators/Access Coordinators describes how to create a CRS profile, how to provide the profile with access, and what the possible roles are in CA Web.

We recommend you begin by reviewing the CA Web User Guide as it explains all aspects of the Corporate Actions Web system.

Welcome! In this section of the DTCC Learning Center you will find resources related to DTC's Corporate Actions Processing Service for Reorganizations and CA Web. Use Quick Links, the Reorg Resources tab (utilize filters to help narrow returned results), and Search to learn more.

DTC’s Corporate Actions Processing Service for Reorganizations provides full lifecycle processing, including sourcing and announcing the details of upcoming events, accepting and acting on instructions, and collecting, allocating, and reporting on the resulting entitlements. The Reorganizations service includes the announcement and processing of events such as exchange offers, conversions, Dutch auctions, mergers, puts, reverse stock splits, tender offers, rights and warrant exercises, and other events arising from the servicing of the securities eligible at the depository. To learn more about Lifecycle Reorganization Processing for Servicing Securites, be sure to visit the Reorganizations page on DTCC's corporate website (www.dtcc.com). You may also wish to visit the By-Laws, Rules and Procedures page for access to various Fee and Service Guides.

DTC’s Corporate Actions Processing Service for Reorganizations provides full lifecycle processing, including sourcing and announcing the details of upcoming events, accepting and acting on instructions, and collecting, allocating, and reporting on the resulting entitlements. The Reorganizations service includes the announcement and processing of events such as exchange offers, conversions, Dutch auctions, mergers, puts, reverse stock splits, tender offers, rights and warrant exercises, and other events arising from the servicing of the securities eligible at the depository. To learn more about Lifecycle Reorganization Processing for Servicing Securites, be sure to visit the Reorganizations page on DTCC's corporate website (www.dtcc.com). You may also wish to visit the By-Laws, Rules and Procedures page for access to various Fee and Service Guides.

Here In the Reorg section of the Learning Center you'll find learning content specific to CA Web such as user guides, help files, eLearning, FAQs and other supporting documentation. Be sure you login and utilize the Resources tab at the top of this page to access content related to:

- CA Web Reorganizations - including

- Reorganizations Dashboard and Announcements,

- Reorganizations Record Detail,

- Reorganizations Entitlements and Allocations, and

- Reorganizations Adjustments.

Note: For information about Distributions and Redemptions functionality in CA Web, be sure to access those areas within the Corporate Actions Processing section of the Learning Center. If you haven't already and you want to familiarize yourself with CA Web, be sure to visit the CA Web section.

Recommended Resources

-

pdf

CA Web User Guide

(20.65 MB)

The CA Web User Guide compiles the contents of the CA Web Help, including information for Distributions and Redemptions and thoroughly explains the CA Web interface and functionality. This is where you'll find the latest and most up-to-date information about CA Web and we recommend it as both the place to start and as a comprehensive learning solution. -

pdf

Provisioning Access and Roles to CA Web Users

(658 KB)

This guide for Super Access Coordinators/Access Coordinators describes how to create a CRS profile, how to provide the profile with access, and what the possible roles are in CA Web.

We recommend you begin by reviewing the CA Web User Guide as it explains all aspects of the Corporate Actions Web system.

Welcome! In this section of the DTCC Learning Center you will find resources to support your use of DTC’s Dividend and Income Processing services. You can use Search, the Resources tab (includes filters to help narrow your search), and Quick Links to learn more.

DTC's Dividend services include announcing, collecting, allocating and reporting dividend, interest and certain principal payments on behalf of its participants with securities in DTC custody. The Dividend and Income Processing section provides additional information about:

- CMO Trade Adjustment System (CTAS)

- PUT Bonds

Login and expand the sections below to learn more.

Welcome! In this section of the DTCC Learning Center you will find the resources you need to maximize your use of DTC’s Issuer Services. You can use Search, the Resources tab (includes filters to help narrow your search), and Quick Links to learn more.

DTC's Issuer Services provide an array of central communication and information resources for depository-eligible securities that facilitate outreach by issuers to shareholders. Through its efficient, cost-effective and risk-mitigating offerings, Issuer Services help achieve timely and accurate communication among interested parties with respect to securities held and serviced at DTC.

DTC's Issuer Services provide an array of central communication and information resources for depository-eligible securities that facilitate outreach by issuers to shareholders. Through its efficient, cost-effective and risk-mitigating offerings, Issuer Services help achieve timely and accurate communication among interested parties with respect to securities held and serviced at DTC.

DTC’s Legal Notice System (LENS) service offers access to a comprehensive online library of notices concerning DTC-eligible securities that are published and furnished by third-party agents, courts and security issuers.

DTC's Security Position Reports (SPR) provide issuers, trustees and authorized third-party agents with valuable information on the position holdings of DTC participants in the issuer’s security as of a specified time period.

DTC's Issuer Agent Portal provides a means for Agents, Trustees, Issuers, and Third-Party Partners to submit notices directly to LENS. The portal allows for entry of pdf Legal and Tax Notices (1.46 MB) as well as pdf Transfer Agent 17Ad-16 Notices (2.20 MB) .

The Resources tab at the top of this page includes items related to Issuer Services in general and also those specific to the Legal Notice System (LENS) and Security Position Reports (SPR).

- For a view of resources pre-filtered to show only those specific to LENS, see the Resources tab at the top of the LENS page (see also Issuer Services menu).

- For a view of resources pre-filtered to show only those specific to SPR, see the Resources tab at the top of the SPR page (see also Issuer Services menu). These views can then be filtered to show resources by topic, format (document, video, etc.), and sorted by title, date of publication, etc.

For answers to general Issuer Services questions, see the FAQs on this page.

Issuers can also learn more about DTC and its role as a central securities depository at the DTCC website.

Welcome! In this section of the DTCC Learning Center you will find the resources you need to maximize your use of DTC’s Legal Notice System (LENS). Use Quick Links, the Legal Notice System (LENS) Resources tab (utilize filters to help narrow returned results), and Search to learn more.

Welcome! In this section of the DTCC Learning Center you will find the resources you need to maximize your use of DTC’s Security Position Reports. You can use Search, the Resources tab (includes filters to help narrow your search), and Quick Links to learn more.

Welcome! In this section of the DTCC Learning Center you will find the resources you need to maximize your use of DTCC’s LIBOR Replacement Index Communication Tool. Use Quick Links and the Resources Tab to access related resources.

Welcome! In this section of the DTCC Learning Center you will find the resources you need to maximize your use of DTCC’s Global Tax Services. Use Quick Links, the Global Tax Services Resources tab (utilize filters to help narrow returned results), and Search to learn more.

Welcome! In this section of the DTCC Learning Center you will find the resources you need to maximize your use of DTCC’s Agent Services. Use Quick Links, the Agent Services Resources tab (utilize filters to help narrow returned results), and Search to learn more.

Welcome to the Agent Services section of this Learning Center. It is designed to facilitate communication with the agent community by providing information and reference documentation that is necessary to interact with The Depository Trust Company (DTC). If you haven't already, DTCC Learning recommends you familiarize yourself with the Agent Services page on DTCC.com, as it provides information related to:

- becoming a DTC-eligible agent,

- the FAST program (see also FAST Agent Learning Resources below),

- the Direct Registration System (DRS), and

- important forms and reference information about Corporate Actions.

The Agent Services section of the Learning Center assumes you have familiarized yourself with the information available on DTCC.com and are either ready to apply for FAST Agent membership, or are already a FAST Agent. In the latter case, be sure to access the FAST Agent Learning Resources, below.

Welcome! In this section of the DTCC Learning Center you will find the resources you need to maximize your use of DTCC’s Settlement offerings. To find the content you need, either use the Search field or select a product below to access user guides, file specifications, video tutorials, and more.

Remember to log in to see the most available content.

Click on the boxes below to learn about the transaction types and activities that make up the settlement process.

IMS allows you to inquire about, authorize, or exempt securities eligible for settlement during the 6 business days beginning with S-1 (the day before settlement), and ending with S+5 (5 days after settlement).

Welcome to the Record Formats and Messages section for DTC settlement. Here you will find technical specification documents outlining the the data format required in order to send and receive data.

The Settlement Web is DTC's primary Settlement user interface. Clients have the ability to view their settlement activity as well as to submit transactions to DTC For end of day settlement.

SMART/Track provides a centralized communications hub for the transmission of various message types between clients.

Welcome! In this section of the DTCC Learning Center you will find the resources you need to maximize your use of DTCC's Mutual Fund Services offerings. To find the content you need either use the Search field or select a product below to access user guides, record layouts , video tutorials, FAQs, and more.

Remember to log in to see all content.

Mutual Fund Services (MF) delivers a broad range of innovative transactional and information services to automate, standardize and centralize processes to create efficiencies and reduce cost and risk for the mutual fund marketplace. MF solutions drive business relationships between asset managers and their distributors, linking a vast network including fund companies, investment managers, broker/dealers, banks, trusts, and other financial services firms that offer fund investments to the market.

Listed below are the products for Mutual Fund Services. Click into each product link below to explore more...

Welcome! In this section of the Learning Center you will find resources that support features, functionality and best practices that apply across multiple MFS products and services. Scroll down to read the brief descriptions and click Learn more to go to the related page.

Remember to log in to see all content.

Money market mutual funds are low-volatility funds that historically sought to maintain a $1-per-share net asset value (NAV), typically by investing in short-duration government securities, certificates of deposit, corporate commercial paper and other highly liquid, low-risk securities.

The Underlying Firm Symbol (UFS) provides a standard method of identifying intermediaries involved in providing service to a mutual fund account.

Fund/SERV® is the U.S. industry standard for processing and settling mutual fund, bank collective fund and other pooled investment product transactions between fund companies and distributors.

ACATS-Fund/SERV® is a dynamic service that automates and standardizes transfers and re-registration of assets in a customer's mutual fund account. These transfers can be between broker/dealers or other distribution firms, or between firms and fund companies.

Defined Contribution Clearance & Settlement (DCC&S) streamlines purchase, redemption, and exchange transactions in defined contribution and other retirement plans for mutual fund and insurance companies, third-party administrators (TPAs), plan trustees, plan administrators, broker/dealers and other distribution firms.

Transfer of Retirement Assets enables mutual fund companies to transfer to other fund companies the assets and values of mutual fund shares held in fund-sponsored IRA plans.

DTCC Payment aXis® automates and streamlines the processing of commissions and various mutual fund fee types, including the transmission and settlement of invoices for broker controlled and retirement plan accounts.

DTCC’s MF Info Xchange facilitates and centralizes the delivery and receipt of time-critical mutual fund, bank collective fund and other pooled investment product notifications to reduce risk throughout the communication process.

In the section, you will find all the resources you need to make the most of MF Info Xchange including a user guide and how to videos.

Mutual Fund Profile Service I Daily Price and Rate File (MFPS I) provides fund companies with an automated solution for delivering prices and daily distribution rates to their intermediaries.

Mutual Fund Profile Service II (MFPS II) is a multi-dimensional repository of two databases that allows funds, broker/dealers and other distribution firms to automate and streamline the exchange of accurate and timely information on securities, participants and distributions.

Networking, offered by DTCC’s Wealth Management Services (WMS), is the industry standard for mutual fund account reconciliation and dividend processing.

Omni/SERV® provides a streamlined communication platform for the transmission of Activity and Position files for fund accounts held in Omnibus, enabling participating trading partners to share sub-account information.

Alternative Investment Product (AIP) Services is a platform that links global market participants — including broker/dealers, fund managers, fund administrators and custodians — to provide one standard, efficient end-to-end process for alternative investments such as hedge funds, funds of funds, private equity, non-traded real estate investment trusts (REITs), managed futures and limited partnerships.

Visit the AIP Client Center to access training documentation, please submit a request to your Relationship Manager for an account or contact the

Welcome! In this section of the DTCC Learning Center you will find the resources you need to maximize your use of DTCC's Insurance & Retirement Services offerings. To find the content you need either use the Search field or select a product below to access user guides, record layouts , video tutorials, FAQs, and more.

Remember to log in to see all content.

DTCC's Insurance & Retirement Services (I&RS) offers a suite of streamlined processing and compliance-driven solutions for carriers and their distribution partners -- broker/dealers, banks, brokerage general agencies, independent broker/dealers and other firms -- through a secure, centralized and automated infrastructure. This infrastructure enables insurance carriers and distributors to exchange information at various points throughout the annuity and life insurance processing cycle.

Listed below are the products for Insurance & Retirement Services. Click into each product link below to explore more...

Commissions (COM) transmits information regarding agent commission and compensation payments from insurance carriers to distributors for annuity and life insurance products. It also provides same-day money settlement.

Licensing & Appointments (LNA) automates and standardizes the two-way flow of information needed to manage producer information between insurance carriers and distributors, eliminating paper and simplifying data exchange.

Producer Management Portal (PMP) provides a comprehensive source for centralizing, sharing, tracking & verifying producer training completions. State & product training & source for authorizations for annuity sales.

Applications & Premium (APP) transmits annuity application and initial premium information from distributors to insurance carriers.

Attachments (ATT) enables insurance distributors and carriers to electronically exchange digital (imaged) documents, signatures, forms and other types of unstructured data during the pre-sale, new business and post-issue processing of annuity and life insurance information.

Asset Pricing (AAP) enables insurance carriers to transmit the unit values for underlying funds within variable annuity and life insurance products to distributors on a daily basis. It provides fund-level pricing information, similar to the net asset value for mutual funds, that may be applicable to multiple insurance products within a carrier’s product line.

Financial Activity Reporting (FAR) enables insurance carriers to provide distributors with daily individual and group annuity and life insurance financial transaction information, giving them a comprehensive and accurate picture of client accounts and helping them supervise and manage those accounts.

DTCC’s Insurance Information Exchange (IIEX) is a platform that provides clients with the ability to exchange policy, producer, and product data through a secure data hub that supports the sourcing and consumption of data.

Positions & Valuations (POV) enables insurance carriers to send annuity, life insurance long-term care and retirement income/immediate annuities contract details on a daily, weekly, monthly or other periodic basis, giving them a current snapshot of their entire book of business.

ACATS / IPS (Automated Customer Acct. Transfers / Insurance Processing Svs.) automates changes in annuities’ broker/dealer of record when clients transfer accounts between brokerage firms.

DTCC’s IFW Services for Financial & Non-Financial Transactions extends support for the post-issue transaction set, allowing distributors to submit requests through mainframe, real-time service or a simple web interface.

The In-Force Web Services Broker Dealer of Record (BDR) Change tool allows distributors to streamline and automate their Broker/Dealer of Record Changes and non-financial transactions, like address and contact changes, to their carrier partners.

As an In-Force Transaction (IFT), this automated service facilitates changes of the representative of record (REP) within the managing firm requested by the distributor when the representative leaves the firm, retires or when business for a customer account is transitioned to another agent.

Settlement Processing for InsuranceSM automates and centralizes the settlement of post-issue money/funding activities between carriers and distributors as well as between carriers, allowing for the optimal facilitation of insurance withdrawals, full and partial surrenders and mandatory required distributions.

Subsequent Premiums (SUB) transmits subsequent premium information from distributors to insurance carriers. The service provides an efficient, straight-through process for validating, formatting, and submitting subsequent premium payments while incorporating same-day money settlement.

Welcome! In this section of the DTCC Learning Center you will find the resources you need to maximize your use of DTCC’s Repository Services offerings. To find the content you need, either use the Search field or select a jurisdiction below to access user guides, file specifications, video tutorials, FAQs, and more.

Remember to log in to see the most available content.

Global Trade Repository (GTR) Overview

DTCC’s Global Trade Repository (GTR) Service provides firms with the ability to report their OTC derivatives transactions, SFT transactions, CCP Margin, and Collateral Reuse data to their corresponding regulatory agency. GTR accomplishes this using a global infrastructure of trade repositories that collect, store, and report the data to both clients and regulators. Currently, GTR has established trade repositories for reporting to multiple jurisdictions.

Choose a Jurisdiction below.

You are reporting derivatives trade data to CFTC / Canada / SEC.

You are reporting derivatives trade data to ESMA or FCA under the EMIR regulation.

You are reporting derivatives trade data to ESMA under the EMIR Refit regulation.

You are reporting derivatives trade data to FCA under the EMIR Refit regulation.

You are reporting SFT Transactions, CCP Margin, and Collateral Reuse data to ESMA or FCA under the SFTR regulation.

You are reporting derivatives trade data to ASIC or MAS.

You are reporting derivatives trade data to Australia (ASIC) under the ASIC Rewrite regulation.

You are reporting derivatives trade data to Singapore (MAS) under the MAS Rewrite regulation.

You are reporting derivatives trade data to JFSA.

You are reporting derivatives trade data to FINMA under the FINFraG regulation.

Welcome! In this section of the DTCC Learning Center you will find the resources you need to maximize your use of DTCC’s Derivatives Services offerings. To find the content you need, use the Search field or select a document below.

Remember to log in to see the most available content.

Access all documentation and technical resources for the DTCC Report Hub service diretly from the online help links on the application user interface.

Welcome to the DTCC Data Services Learning Center! This section contains all the resources you need to maximize your use of the DTCC Data Services offerings, including user guides containing file specifications and FAQs, sample files and videos. Always log in to see the most content available to you.

DTCC Data Services offers referential and activity-based data, delivered in fixed or configurable formats. All data is sourced from DTCC’s transaction, reference, position and asset servicing data and covers all major asset classes.

Listed below are the products for DTCC Data Services. Click into each product link to explore more...

DTCC CDS Kinetics provides market risk perspectives on credit derivatives traded globally, by utilizing position data sourced from DTCC’s Trade Information Warehouse (TIW). TIW is a centralized infrastructure for reporting and asset servicing on approximately 98% of all credit derivative transactions outstanding worldwide.

DTCC Equity Kinetics enables users to view, track and analyze aggregated U.S. equities trade volumes over time and in the context of broader market activity.

DTCC’s Money Market Kinetics provides a single, daily feed of anonymized CP and CD secondary settlement transactions data–excluding IPA to dealer–to enhance analysis of this enormous market.

DTC End of Day Position provides the total positions held at DTCC Depository Trust Company (DTC), the largest central securities depository in the world.

DTCC Treasury Kinetics enhances the transparency of the U.S. Treasury repurchase agreement (repo) market by delivering a daily summary of aggregated and anonymized repo trade activity.

DTCC’s OTC Direct Connect provides subscribers with a systematic delivery mechanism for OTC derivatives transaction data published on DTCC Data Repository (U.S.) LLC’s (DDR) public price dissemination dashboard (PPD Dashboard).

DTCC’s CA 20022 Service utilizes Corporate Action Identifier and the ISO 20022 common messaging language to deliver near-real-time messaging on corporate action announcements for 1.3 million active security issues.

DTCC's CA Web Service offers a near-real-time, consolidated source for DTC-eligible announcements in a feature-rich browser.

DTCC’s ETF Portfolio Data Service enhances users’ decision-making in the management of Exchange-Traded-Fund (ETF) portfolios with a consolidated, convenient and consistent feed of U.S.-listed ETFs.

DTCC’s Legal Notice System (LENS) Data provides a comprehensive, searchable library, updated daily, of legal notices concerning DTC-eligible securities that are published and furnished by third-party agents, courts and security issuers.

DTCC’s Security Master File Data service provides the most up to date, comprehensive, centralized and reliable source of DTCC eligible securities' information to the market.

DTCC’s Liquidity Coverage Ratio (LCR) Service provides a calculation of commercial paper (CP) market exposure that helps market participants determine optimal capital obligations.

Welcome to the DTCC Connectivity Document Repository. In this section of the DTCC Learning Center you will find the resources you need to enable you to connect to DTCC's products and services. To find the content you need, use the On This Page link to navigate to the appropriate content.

Remember to log in to see all content.