Enrichment using the standard ALERT enrichment process enables both broker/dealers and investment managers to select which SSI should be enriched from ALERT on a trade by trade basis.

Explore the topics below to understand more about how this process works.

The below diagram steps through the standard ALERT enrichment process. Hover over each numbered step in the workflow to learn more.

In order to enrich SSIs from ALERT, your organization needs to use both the ALERT and CTM services. The below table outlines the specific subscriptions that you need to have enabled and active within your ALERT and CTM organizations.

| Subscription | ALERT Organization | CTM Organization |

| Pre-requisite subscription | ALERT Web | ALERT SSI |

CTM supports the standard ALERT enrichment process through all of its user and message interfaces (Direct XML, FIX and MTI). For futher details and to see specific fields and formats that should be used to leverage this functionality, please reference the relevant Message Specification for the interface you use, available within the CTM Technical Resources area.

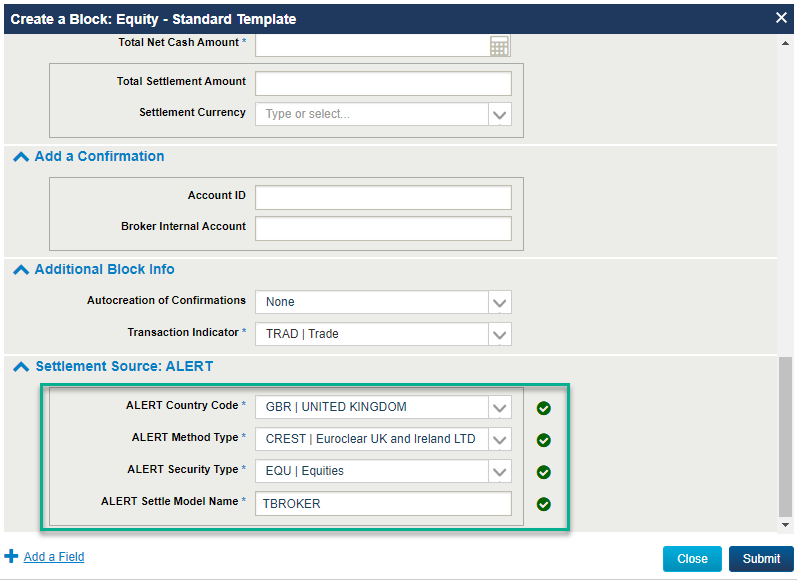

The Settlement Source: ALERT fields are available when using any of the Create Block templates. NOTE: users may have to Add a Field to add these fields to their template if they aren't already available.

All fields in the Settlement Source section have to be populated in order to meet the criteria to submit a block message when using ALERT enrichment.

Facilitated ALERT SSI Enrichment (FASE)

When using the standard ALERT enrichment process as outlined above to enrich their allocations with SSIs, CTM investment managers are required to provide the 3 ALERT keys identifying the settlement country, method and security type, in addition to the Settlement Source Indicator and the ALERT Account/Access Code e.g., USA-DTC-EQU for a U.S. equities trade settling at the DTC. CTM uses these keys to identify the specific SSI that the investment manager wants to enrich from their ALERT data and the keys provided must match exactly to how the SSI is set up in ALERT.

There are use cases where deriving the correct ALERT keys can be complicated. Facilitated ALERT Enrichment (FASE) addresses these issues by relaxing the requirement to supply all three keys. Instead, FASE derives the correct keys based on other trade information such as the Type of Financial Instrument (TOFI). FASE will also source the SSIs for a given market when a more granular security type key has been provided but the ALERT SSI is stored under a more general security type e.g., if the investment manager provides a security type key of ETF, FASE will first look to enrich the ETF SSI but if there is no active ETF instruction for the account, FASE will instead enrich the EQU instruction if available. For further information on these groups, please see ALERT Security Types and Security Type Groups.

To learn more about the use cases for FASE, how to implement and next steps, review the below topics.

More investment managers are taking advantage of the ALERT Global Custodian Direct (GCD) functionality whereby the custodian maintains the SSIs on behalf of the investment manager. In this scenario, the global custodian typically stores SSIs using one of the following top-level Security Type Groups:

- EQU: for all equity SSIs

- COB: for all fixed income and US-DTC SSIs

- TRY: for all government fixed income SSIs, including Fedwire-settling instruments such as Treasuries, Mortgages and Agency Debt

- MMT: for money market SSIs

If, prior to switching to use the ALERT GCD functionality, the investment manager stored their SSIs using a more granular-level security type (e.g., ETF instead of EQU) and they didn't update their SSIs or didn't turn on the FASE functionality, ALERT enrichment will fail.

A significant number of ALERT enrichment errors are related to this issue, which in turn results in downstream processing exceptions such as SWIFT messaging and the auto-affirmation of US DTC ID confirms.

- Investment managers who are unable to provide all ALERT keys

- Investment managers who are switching their SSIs to an ALERT GCD-managed model

To implement FASE, the following subscriptions/subscription options need to be applied to your CTM organization:

| Subscription/Subscription Option | Name | Code | Description |

| Subscription | Facilitated ALERT SSI Enrichment | - | Turns on the functionality to derive the ALERT key when it is either not provided or the value provided cannot be found in ALERT |

| Subscription Option | Facilitated ALERT Enrichment Fields | FAEF |

Returns 2 additional fields to the CTM investment manager in the InfoResponse and InfoSettlementResponse messages. The subscription option FAEF should be set to Y to enable this feature.

FacilitatedALERTSSIEnrichmentIndicator: when Facilitated ALERT SSI Enrichment occurs, this field indicates which of the three ALERT fields (AlertCountryCode, AlertSecurityType and AlertMethod were derived by CTM or returned from ALERT.

FASEUsed: when Facilitated ALERT SSI Enrichment occurs, this Boolean indicator is set to Y. It indicates if Facilitated ALERT Enrichment ever occurred on the investment manager's allocation (Trade Detail) during the trade's progression to a MATCH AGREED (MAGR) status. |

- For investment managers who would like to reduce errors when enriching from ALERT, it is recommended that you turn on the Facilitated ALERT SSI Enrichment subscription.

- If you would like the additional fields returned on your CTM messaging, you will also require the Facilitated ALERT Enrichment Fields subscription option.

- To enable both of these features, your CTM Product Administrator will need to submit a support request through MyDTCC, using the following criteria:

- Product = CTM

- Topic = Other

- Subject = Check CTM Subscriptions

- Description = provide details of the subscriptions/subscription options required.

Alternatively, CTM investment managers can also explore using the ALERT Key Auto Select (AKAS) functionality to automate ALERT SSI enrichment. Visit AKAS to learn more.