ALERT Key Auto Select (AKAS) functionality enables rules-based enrichment of CTM trades with preferred SSIs sourced from the ALERT platform.

Click on the image below to watch a short introductory video to learn more or explore the below topics for more detailed information.

AKAS uses trade information to derive the country and security type for a transaction and determine the default depository. Clients can override default choices and indicate settlement location preferences enabling settlement for each security type and geography to be made into and out of a single preferred depository for each account. This functionality is available to both broker/dealers and investment managers and can be applied at the CTM organization-level (CTM BIC) or on a trade-by-trade basis.

Explore the topics below to learn more about AKAS works, the path to implement including requirements, how to set up override rules and sample message formats. In addition, further details can be found in the pdf CTM: ALERT Key Auto Select (AKAS) Implementation Guide (1.19 MB) .

The below diagram steps through the AKAS enrichment process. Hover over each numbered step in the workflow to learn more.

The below timeline demonstrates the steps required for an investment manager to implement AKAS. Click on each step to learn more.

In order to use AKAS functionality to enrich your SSIs, you need to be a user of both ALERT and CTM. The below table outlines the specific subscriptions and user roles that you need to have enabled and active for your ALERT and CTM organizations.

| Subscription/Role Type | CTM Organization | ALERT Organization |

| Pre-requisite subscription | ALERT SSI | ALERT Web |

| New subscription | AKAS CTM Retrieval | ALERT Keys Auto Select |

| New subscription option (optional) | AKAS Hardwired (HWIR) | |

| User Roles | AKAS Rules Read | |

| AKAS Rules Write |

If your CTM organization has the AKAS Hardwired subscription, there is no requirement to provide any ALERT keys or additional fields to indicate you want to use the AKAS functionality. AKAS enrichment will be applied automatically.

If your CTM organization has the AKAS CTM Retrieval subscription, for each trade that you send to the CTM service, you must supply a value of AKAS in the SettlementSourceIndicator field to indicate that you want the AKAS functionality to be used to enrich the SSI on the trade.

AKAS does not allow the entry of overrides with identical parameters and different outcomes, but does allow the entry of rules with different or additional qualifying parameters. In the case of multiple allowable overrides for a transaction, AKAS always chooses the override with the highest number of matching parameters. In addition, the Security parameter always takes precedence over other overrides with the same number of parameters that omit a Security parameter.

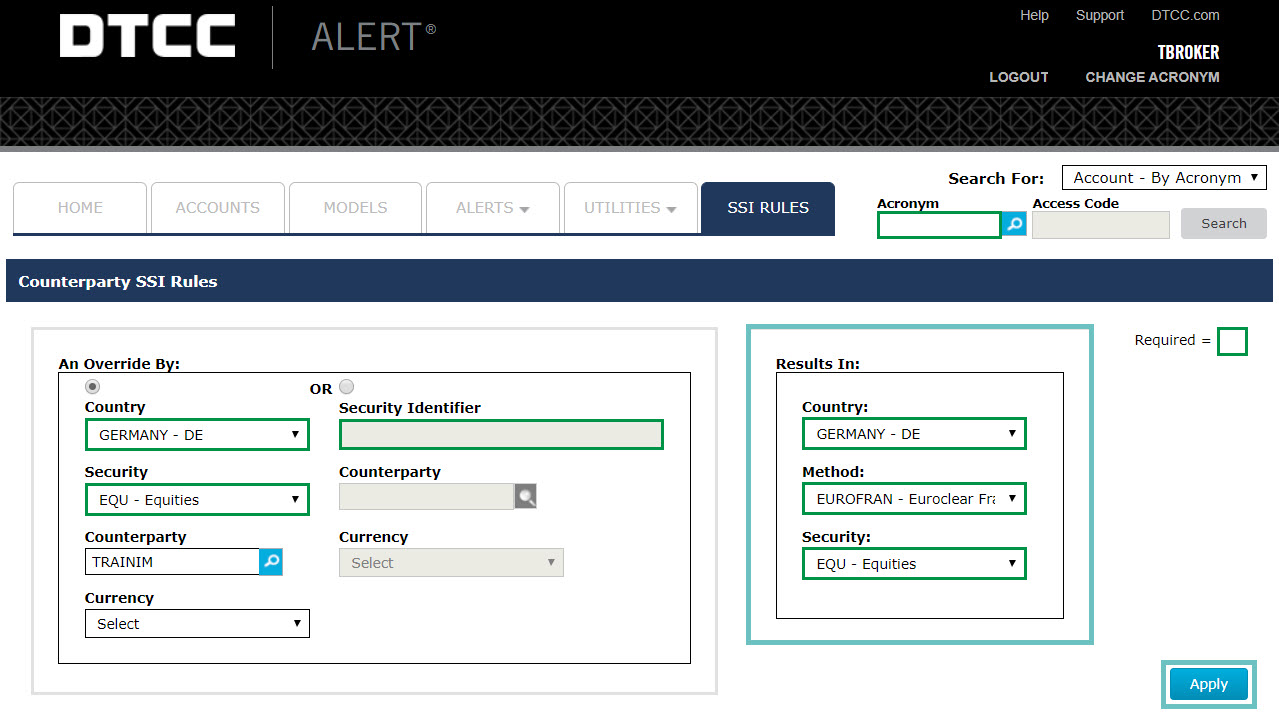

Broker/dealers can set AKAS override rules at the acronym and counterparty level. Below are the step by step instructions to create and maintain AKAS override rules using the ALERT User Interface.

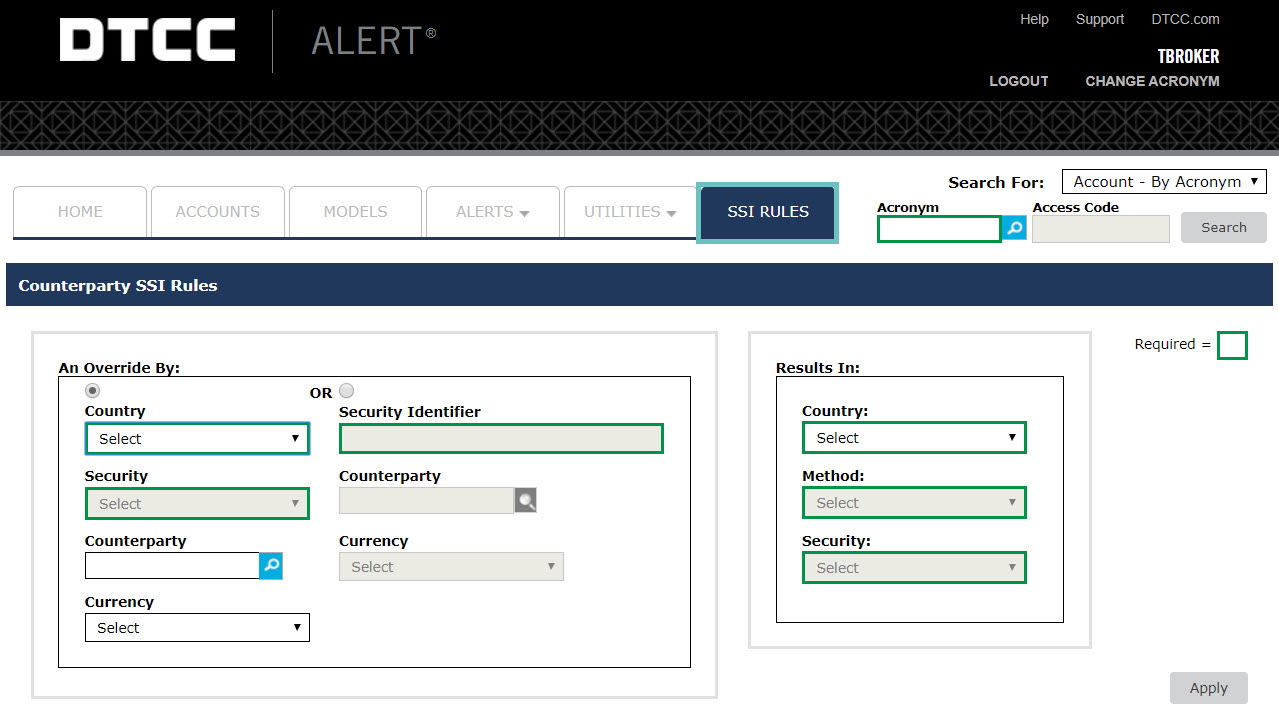

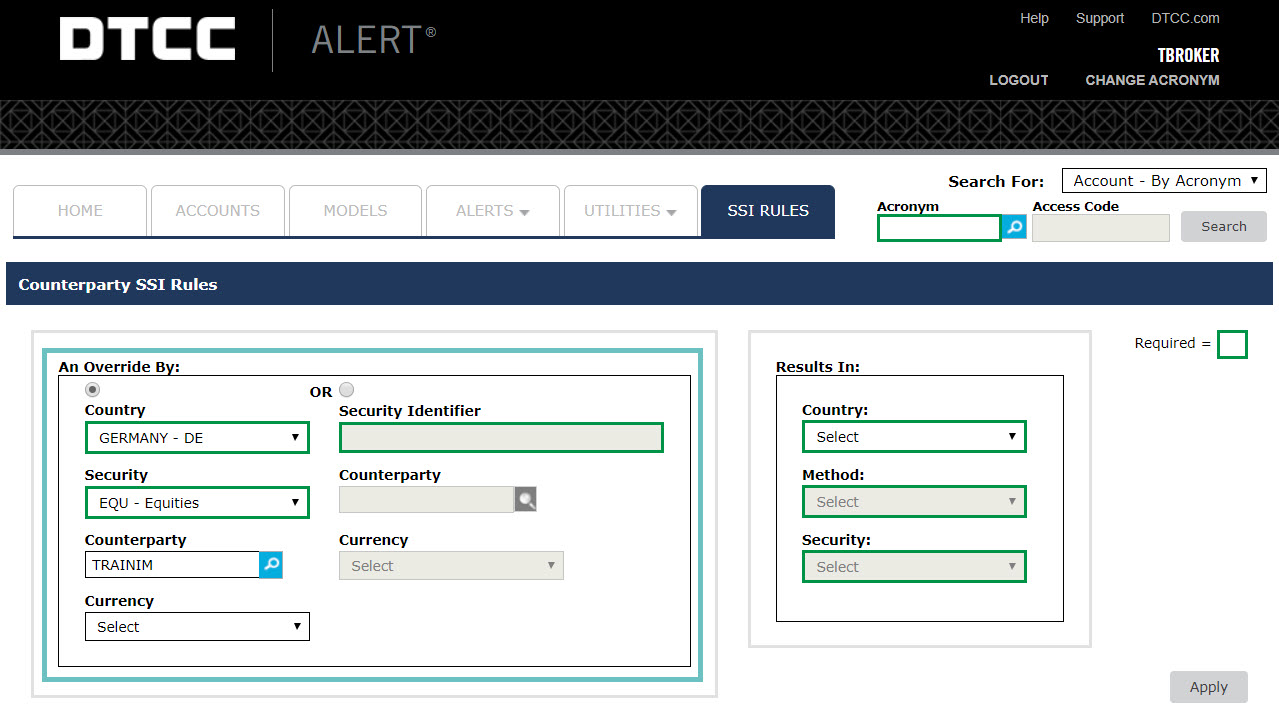

Open ALERT and select the SSI Rules tab. You must have the AKAS roles assigned to your username to see and access this tab.

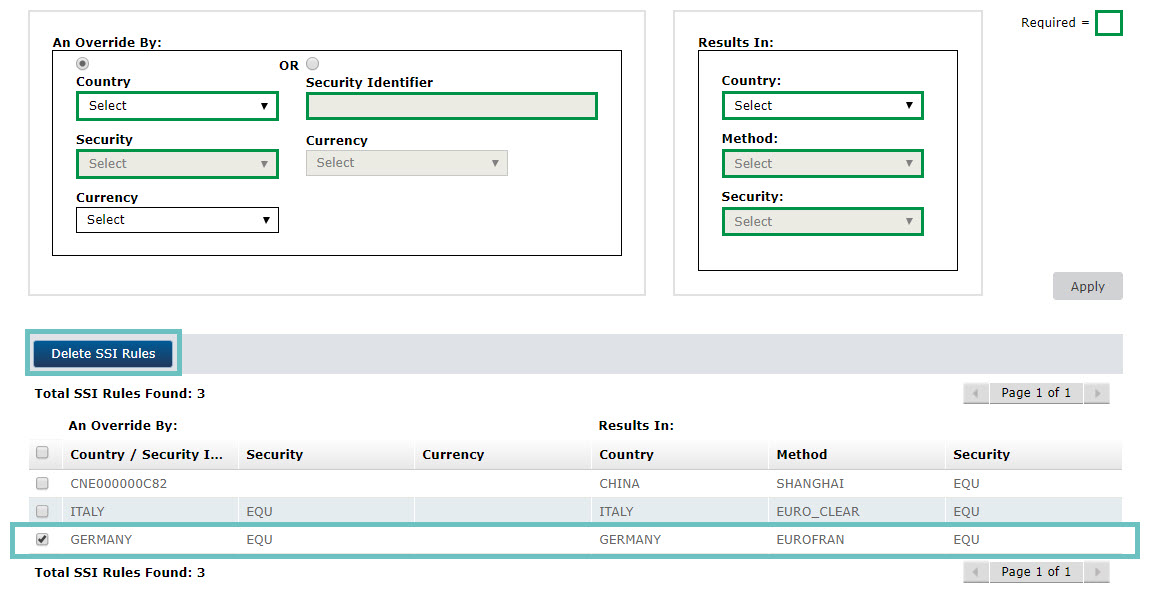

Select the appropriate radio button for either a Country and Security or Security Identifier override and complete fields as required. Those highlighted in green are mandatory.

To set the override at counterparty level, select the acronym of your counterparty. If this field is left blank the override will be applied at acronym level.

In the Results In section, specify your default override result i.e. the SSI you want to be applied for the chosen Country/Security combination or Security Identifer.

Click Apply.

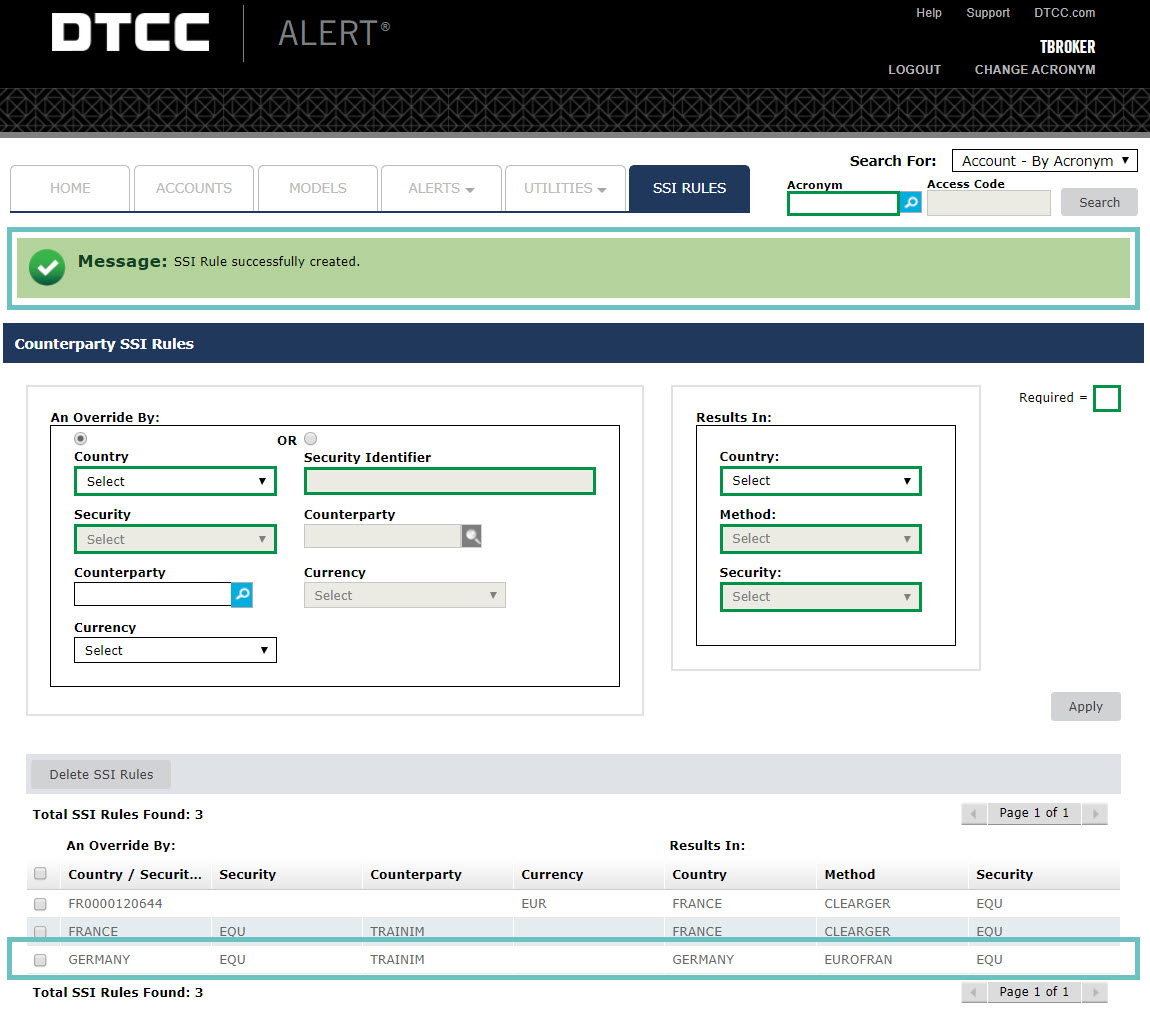

A confirmation message is displayed to show that your SSI Rule has been successfully created and your newly created override is displayed in the table at the bottom of the page.

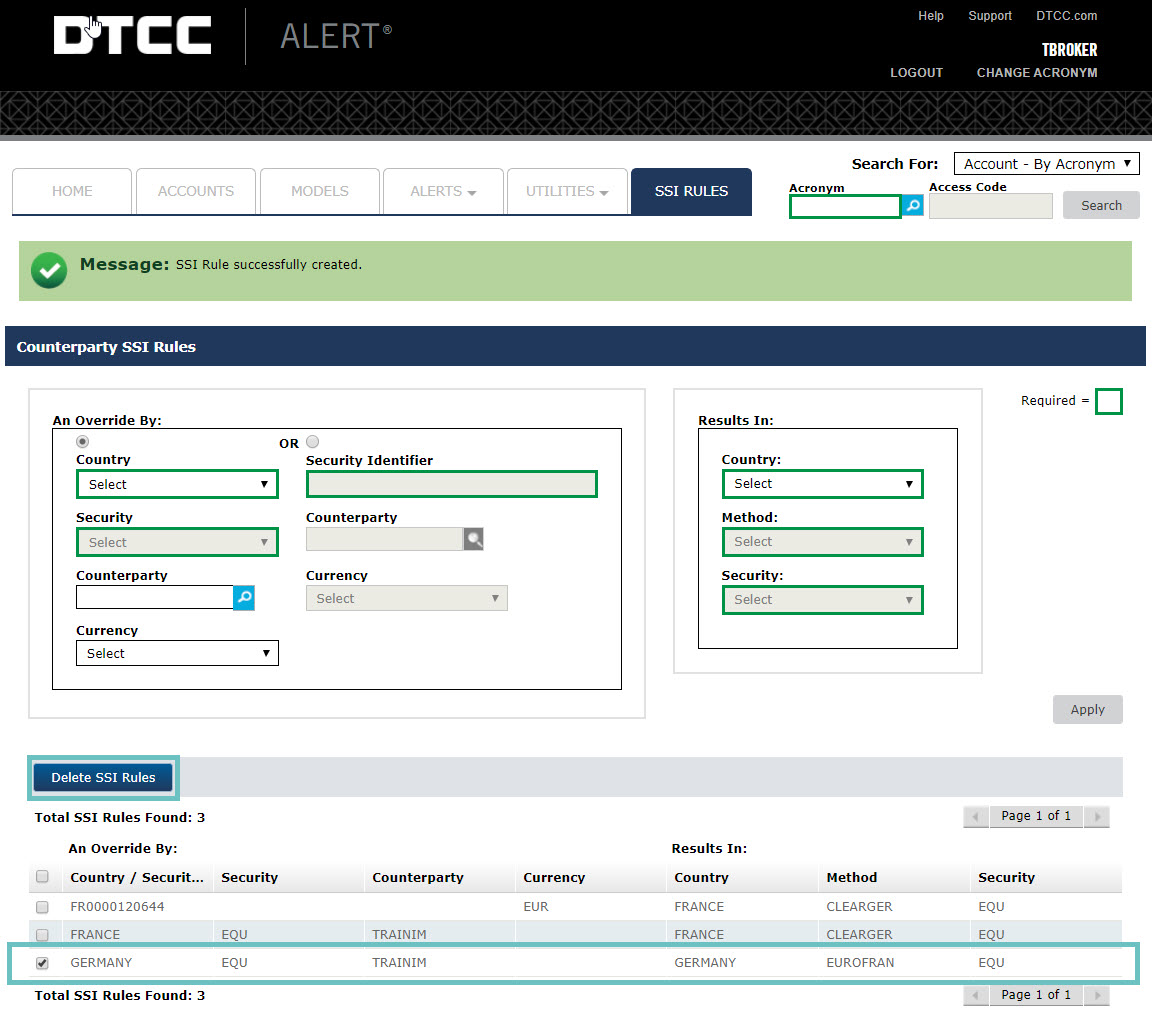

If you need to make modifications to your override rule, you must delete your existing override rule and create a new one. The Delete SSI Rules button is enabled once you select one or more rules to delete.

AKAS does not allow the entry of overrides with identical parameters and different outcomes, but does allow the entry of rules with different or additional qualifying parameters. In the case of multiple allowable overrides for a transaction, AKAS always chooses the override with the highest number of matching parameters. In addition, the Security parameter always takes precedence over other overrides with the same number of parameters that omit a Security parameter.

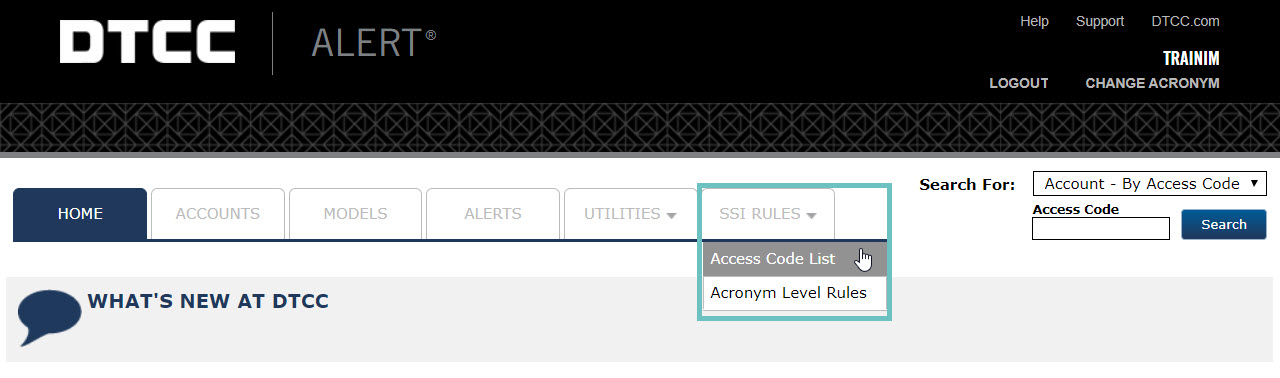

Investment amnagers can set up AKAS override rules at the Acronym, Access Code or Access Code List level. Below are the step by step instructions to create and maintain AKAS override rules using the ALERT User Interface.

To set overrides at Acronym or Access Code List level, open ALERT and select the SSI Rules tab. Select whether the override rule should be applied at Acronym level or Access Code List level.

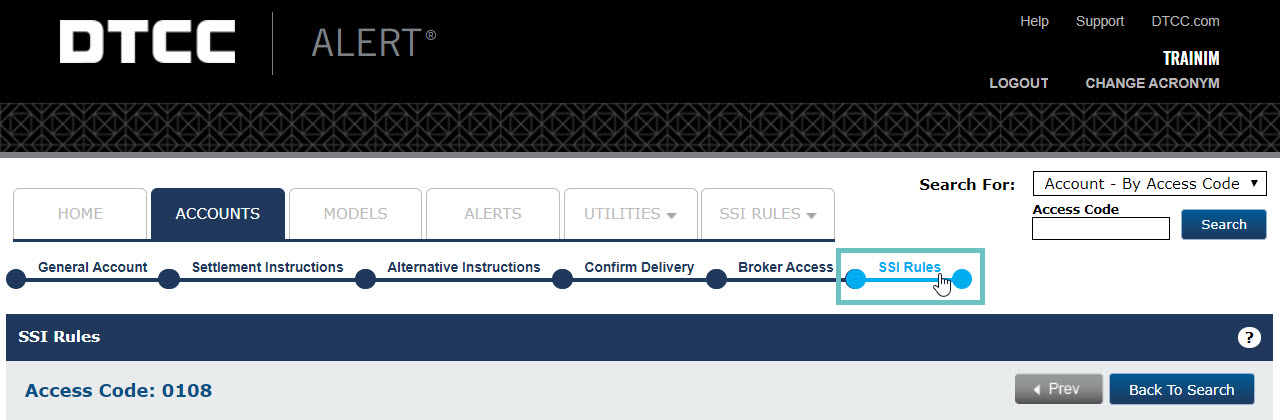

To set overrides at Access Code level, navigate to the Access Code to which the rules apply and select the SSI Rules section.

You must have the AKAS roles assigned to your username to see and access these options.

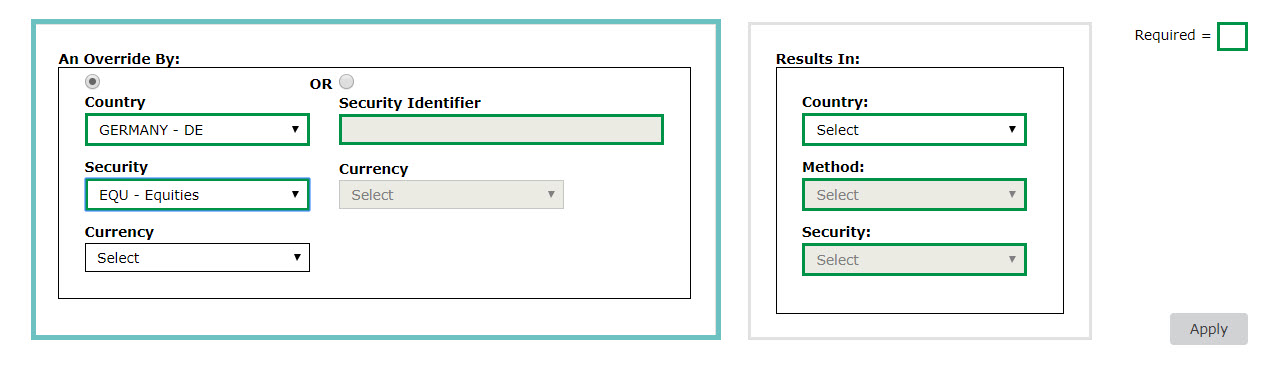

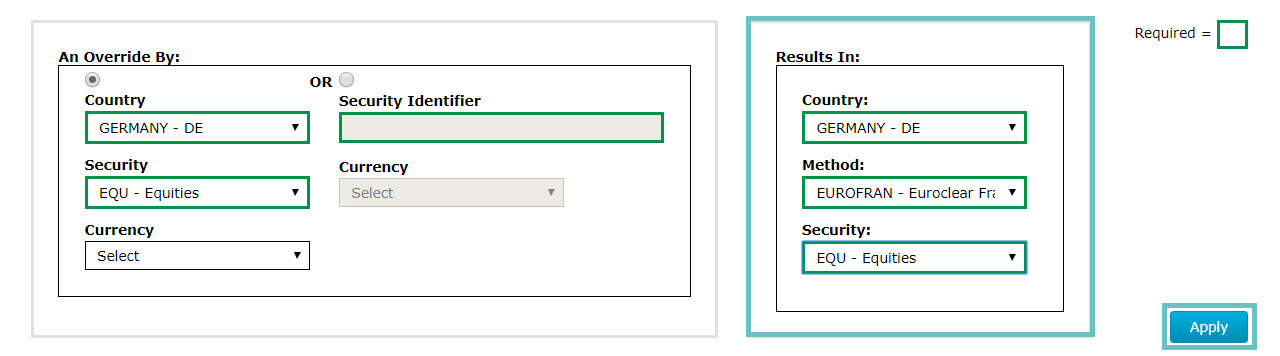

Select the appropriate radio button for either a Country and Security or Security Identifier override and complete fields as required. Those highlighted in green are mandatory.

In the Results In section, specify your default override result i.e. the SSI you want to be applied for the chosen Country/Security combination or Security Identifier.

Click Apply.

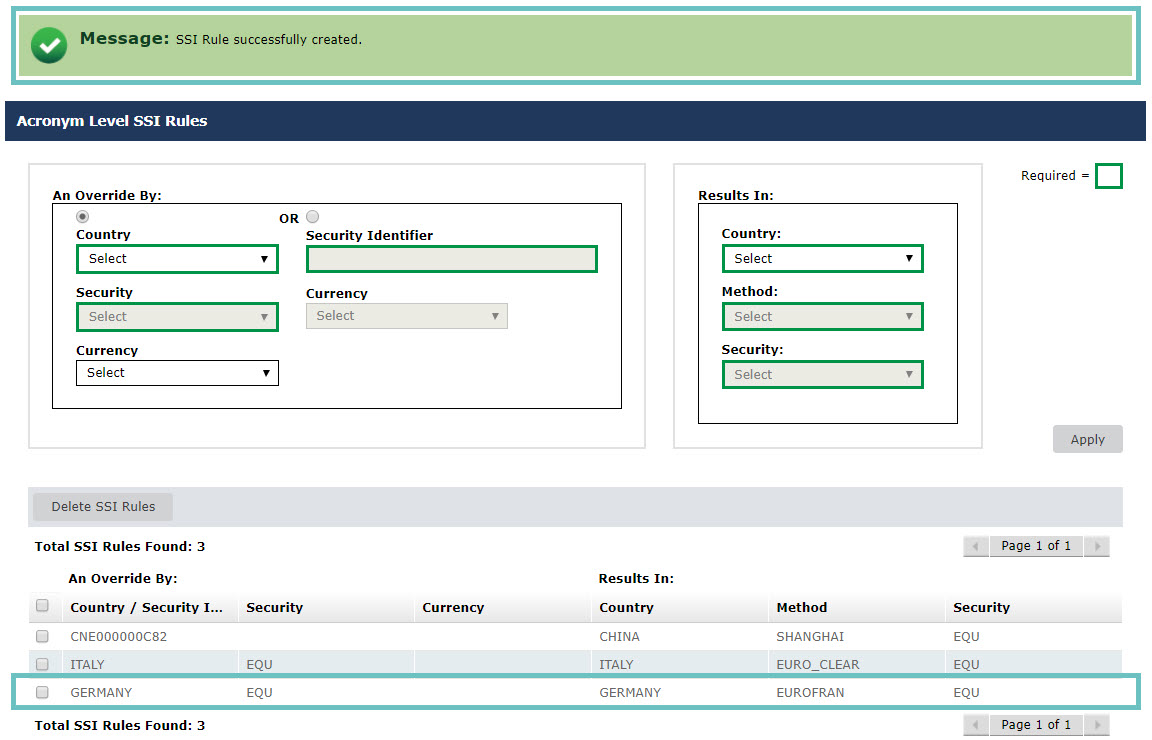

A confirmation message is displayed to show that your SSI Rule has been successfully created and your newly created override is displayed in the table at the bottom of the page.

If you need to make modifications to your override rule, you must delete your existing override rule and create a new one. The Delete SSI Rules button is enabled once you select one or more rules to delete.

CTM supports the AKAS feature on all of its user interfaces (UI 4.0 and UI 3.0) and message interfaces (Direct XML, FIX and MTI). For further details and to see the specific fields and formats that should be used to leverage this functionality please reference the pdf CTM: ALERT Key Auto Select (AKAS) Implementation Guide (1.19 MB) , and in particular section 4. Using AKAS in CTM.

In response to clients who want to benefit from AKAS without the need to change their existing interface, the AKAS Hardwired subscription option overrides any value provided in the SettlementInstructionsSourceIndicator field, regardless of what clients have populated on their inbound message to the CTM service. The AKAS functionality is unchanged but this subscription option automatically invokes the AKAS enrichment process on all trades, unless the client indicates otherwise.

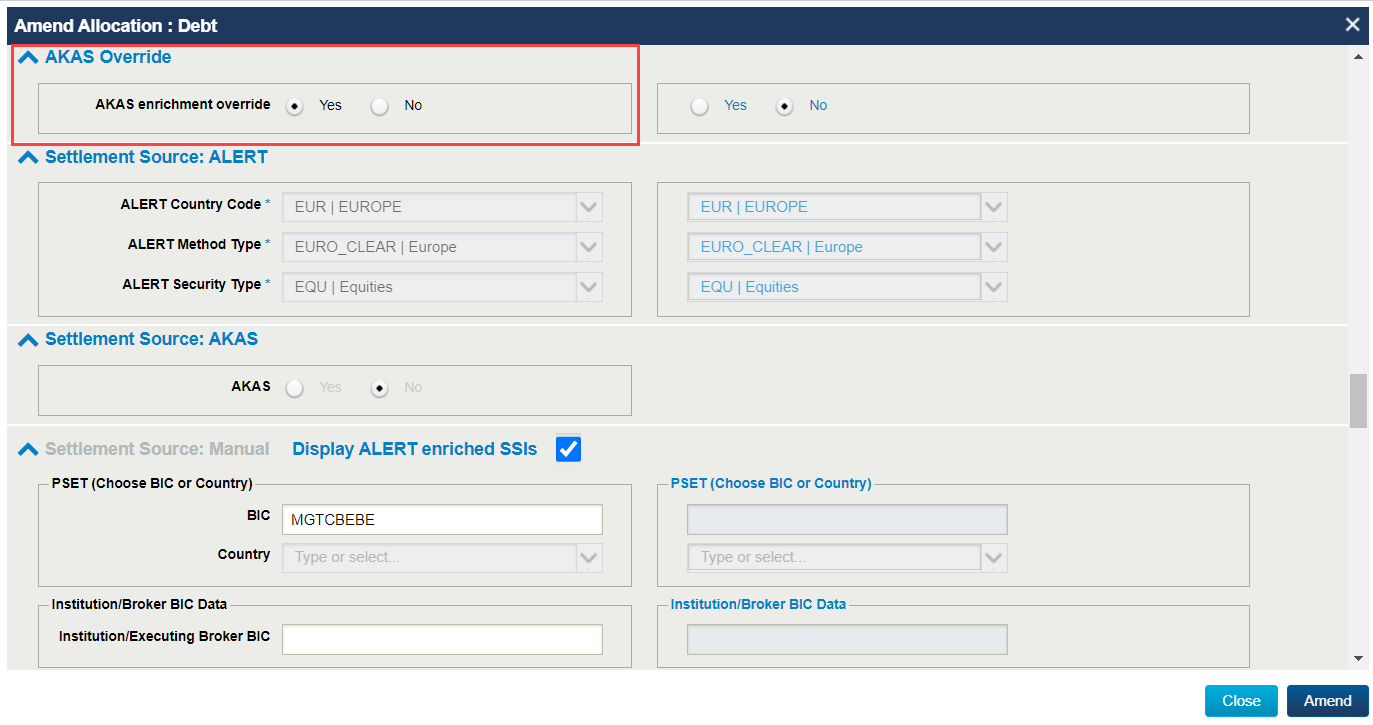

Overriding the AKAS Hardwired Subscription on a Single Trade Component

In cases where a client needs to override the AKAS Hardwired enrichment on a trade component, either block or allocation, CTM provides the AkasUseSettlementInstructionSourceIndicator field. When the value provided in this field is set to Y, CTM is directed to use the values provided in the SettlementInstructionSourceIndicator field with the expectation that the ALERT keys are also provided to indicate the specific SSI to be enriched.

There is also an option through the CTM UI 4.0 which allows users to override the AKAS Hardwired subscription and populate the ALERT keys as required. From the Amend Block or Allocation screen, set the AKAS enrichment override button to Yes, and then in the Settlement Source: ALERT section, select the ALERT keys to indicate which SSI should be enriched. When you select Amend to save your changes, CTM will perform a new enrichment lookup using your newly provided ALERT keys.