When an investment manager uses Broker Matching Groups (BRMGs) to identify the executing broker on their trades, if the BRMG contains more than one broker BIC, the CTM broker can only view the investment manager side of the trade when it has a status of matched (MACH) or mismatched (MACH). Without visibility into unmatched blocks, brokers are not able to proactively address STP breaks. Instead, such breaks require manual intervention and communication outside of CTM thus slowing trade confirmation and introducing risk.

CTM provides a broker 2 ways of achieving increased transparency into an investment manager counterparty's allegements when that investment manager uses a BRMG:

- View Only Broker (VOB): the broker can create a new VOB BIC and when the investment manager adds this to their BRMG, the broker will have full transparency into client allegements.

- Match Advisor: CTM compares a broker's block against counterparty blocks and advises of potential matches

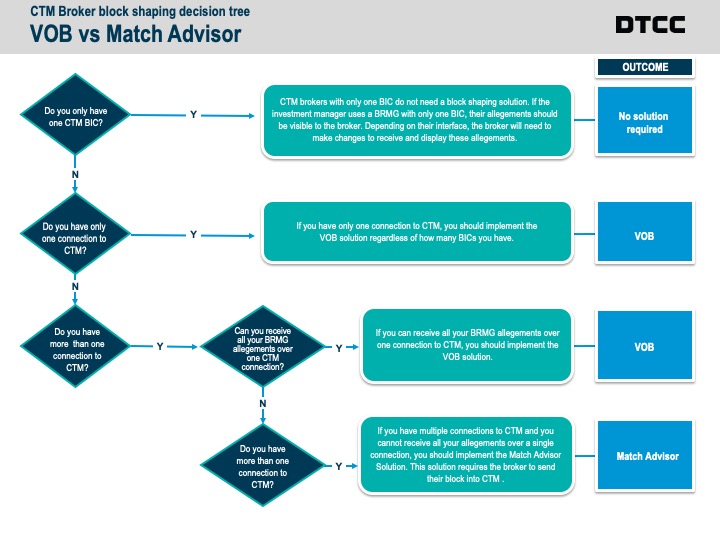

Brokers can use the below block shaping decision treee to consider which option is best suited to their set up. Further details of both options can be found below.

A View Only Broker (VOB) BIC provides full transparency into unpaired investment manager blocks when the broker is specified using a BRMG. VOB is a good solution for brokers with a single connection to CTM because this solution delivers all BRMG allegements to the same location. If a broker has multiple connections to CTM, for example, one for fixed income and a second for equity, Match Advisor is a better solution because it routes allegements back to the connection that submitted the trade.

| Solution | Description | Status | Advantages | Broker Work | Limitations |

| View only broker (VOB) | Broker creates a new BIC. When investment manager adds to Broker Matching Group (BRMG), provides full transparency into client block allegements | Currently Available |

• Full transparency into allegements when investment manager uses a BRMG • Sends all allegements to a single location at the dealer • Broker is not required to submit their block |

• Broker must implement poller or receive pushed events for allegements |

• Only XML poller can be filtered by Security Type • All allegements are delivered to one dealer interface • Broker must pair off 1:1 against investment manager block shapes • Requires updates to investement manager BRMG to add VOB |

| Match Advisor | CTM compares broker’s block against counterparty blocks and advises on potential matches | Currently Available | • Each broker’s CTM connection receives block shape advises for their book—regardless of whether investment manager uses Broker Matching Group (BRMG) | • Broker must implement a new MultiInfoResponse or a FIX AE message to receive Match Advice. |

• Broker must shape blocks to match 1:1 against investment manager blocks • Broker is required to submit their block first |

View Only Broker (VOB)

A View Only Broker (VOB) is a broker BIC that allows a broker to view unmatched blocks alleged against them when an investment manager uses a Broker Matching Group (BRMG) with more than one broker BIC. The VOB is only used to view trades. CTM Brokers continue to confirm trades as they do today with a non-VOB BIC.relaxing of CTM mandatory pairing criteria.

Many brokers did not code their CTM interface to view unmatched blocks sent by an investment manager. As a workaround, some investment managers sent files away from CTM, duplicating data already present in CTM, creating redundancies and additional manual effort. Once the CTM Broker has setup a View Only Broker (VOB), an investment manager, or the ITP Service Bureau on their behalf, needs to add the VOB to the relevant Broker Matching Group (BRMG). As soon as the VOB is added, the broker can view unmatched alleged blocks. This transparency brings greater efficiency to trade confirmation, especially when the investment manager is splitting their blocks.

Please refer to the CTM: View Only Broker Implementation Guide and Procedures for more information.

Implementing View Only Broker (VOB)

The broker needs to engage DTCC Integration and sign a CTM Schedule Addendum to obtain an additional BIC. The broker will then need to setup the View Only Broker (VOB) on their CTM client interface. In addition to achieving transparency, the broker will need to shape their own blocks to match the investment manager. VOB requires the investment manager or the DTCC Service Bureau on behalf of the client to insert the VOB into the investment managers Broker Matching Group (BRMG).

Using Near Pair as a Block Transparency Solution

CTM 4.0 UI enables Brokers to view alleged counterparty not-matched-blocks including where the Investment Manager has used a Broker Matching Group (BRMG).

To learn more about Near Pair, watch the video Working with Not Matched Trades

Investment Managers who add their broker’s View Only Broker (VOB) to their Broker Matching Group's (BRMG’s) will be enabling their broker’s to view and respond to STP breaks more quickly.

You can add a View Only Broker (VOB) to any Broker Matching Group (BRMG) in the Client Facing Dashboard BRMG tool. To learn more, refer to the videos How to Manage Your Broker Matching Groups (BRMGs). The list of View Only Brokers is available in the Client Facing Dashboard Broker Matching Group (BRMG) tool.

Match Advisor

CTM provides a way of achieving increased transparency into an investment manager counterparty’s allegements when that investment manager using a Broker Matching Group (BRMG). If a broker has multiple connections to CTM, for example, one for fixed income and a second for equity, Match Advisor is a better solution because it routes allegements back to the connection that submitted the trade.

Implementing Match Advisor

The broker needs to engage with DTCC integration to setup Match Advisor. The Match Advisor solution requires brokers to proactively submit blocks into CTM as opposed to passively receiving alleged trades. Match Advisor provides actionable pairing recommendations (Match Advice) which would otherwise have to be locally developed. Match Advisor regularly returns Match Advice for unpaired broker blocks irrespective of quantity and with full block transparency irrespective of Broker Matching Group (BRMG) usage. For more information please refer to the pdf CTM: Match Advisor: Overview and Implementation Guide (450 KB) .

When an investment manager uses a Broker Matching Group (BRMG) with more than one BIC, brokers can only view trades when they are matched or mismatched. Without visibility into unmatched blocks, brokers are not able to proactively address STP breaks. Instead, such breaks require manual intervention and communication outside of CTM thus slowing trade confirmation and introducing risk.

When utilizing Match Advisor, it is important for the investment manager to ensure:

- Each Broker Matching Group (BRMG) contain only a single broker

- All the available broker View Only Brokers (VOBs) have been added to the appropriate Broker Matching Group (BRMG)